IRS Announces 2016 Retirement Plan Limitations

The IRS recently announced cost‑of‑living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2016. In general, the pension plan limitations will not change for 2016.

However, the following minor limitations changes are effective January 1, 2016:

- For an IRA contributor who is not covered by a workplace retirement plan and is married to someone who is covered, the deduction is phased out if the couple’s income is between $184,000 and $194,000, up from $183,000 and $193,000.

The AGI phase-out range for taxpayers making contributions to a Roth IRA is $184,000 to $194,000 for married couples filing jointly, up from $183,000 to $193,000. For singles and heads of household, the income phase-out range is $117,000 to $132,000, up from $116,000 to $131,000.

The AGI phase-out range for taxpayers making contributions to a Roth IRA is $184,000 to $194,000 for married couples filing jointly, up from $183,000 to $193,000. For singles and heads of household, the income phase-out range is $117,000 to $132,000, up from $116,000 to $131,000.- The AGI limit for the saver’s credit (also known as the retirement savings contribution credit) for low- and moderate-income workers is $61,500 for married couples filing jointly, up from $61,000; $46,125 for heads of household, up from $45,750; and $30,750 for married individuals filing separately and for singles, up from $30,500.

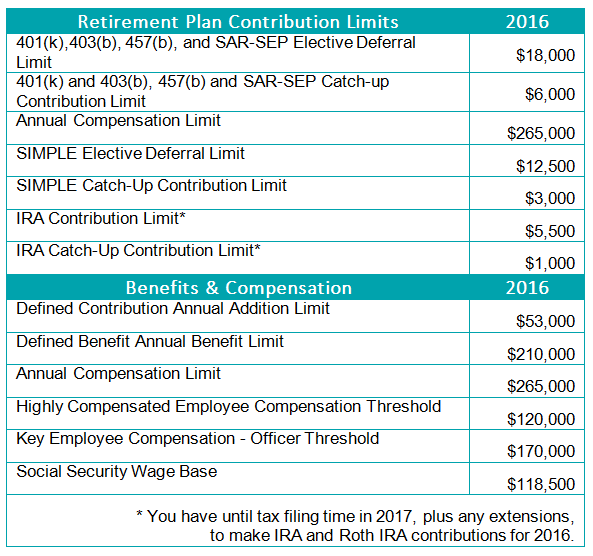

The following retirement plan contribution limits remain unchanged, but may serve as a reminder when conducting your 2015 year-end tax planning.

If you haven’t already reached your contribution limits when funding your retirement account for the current tax year, AAFCPAs reminds you to do so by your plan’s contribution deadlines. This can help you lower your current and future tax liabilities, leverage your corporate match program, and allow your contributions to compound tax-deferred or tax-free.

Every tax situation is unique and requires a careful and comprehensive plan. AAF’s proactive and innovative approach to tax planning enables our clients to decrease both their current and future tax liabilities, and achieve compliance with confidence.

If you have any questions about benefit plan contributions, or year-end or multi-year tax planning, please contact your AAFCPA partner.

AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.