Blog

Our Blog acts as a great resource of topical information for the finance community. Use the search function to find specific topics or browse our categories to benefit from our past shared learnings.

Court Upholds Massachusetts Tax on Business Gain After Owner Relocates

In this article: The Massachusetts Appeals Court recently ruled that a tech founder’s $4.7 million stock sale could be subject to state income tax, despite his move out of state. Craig Welch, who co-founded AcadiaSoft, Inc. in 2003, initially held a 50-50 ownership split with one partner, though his interest was diluted over time as […]

AAFCPAs Launches New Early Career Advisory Committee to Advance Innovation

AAFCPAs has launched a new internal advisory group designed to bring forward ideas and perspectives from the next generation of insight-driven CPA and advisory professionals. Called the Early Professional Insights Committee (EPIC), the group gives a voice to team members at the staff through senior levels, empowering them to examine processes, recommend improvements, and contribute […]

IRS to End Paper Checks in 2025

Beginning in September 2025, the federal government will phase out paper checks to the Internal Revenue Service (IRS), ending a long chapter in the way Americans exchange money with the agency. Under a sweeping mandate issued by the U.S. Treasury, all federal disbursements including tax refunds must be paid electronically, and paper refund checks will […]

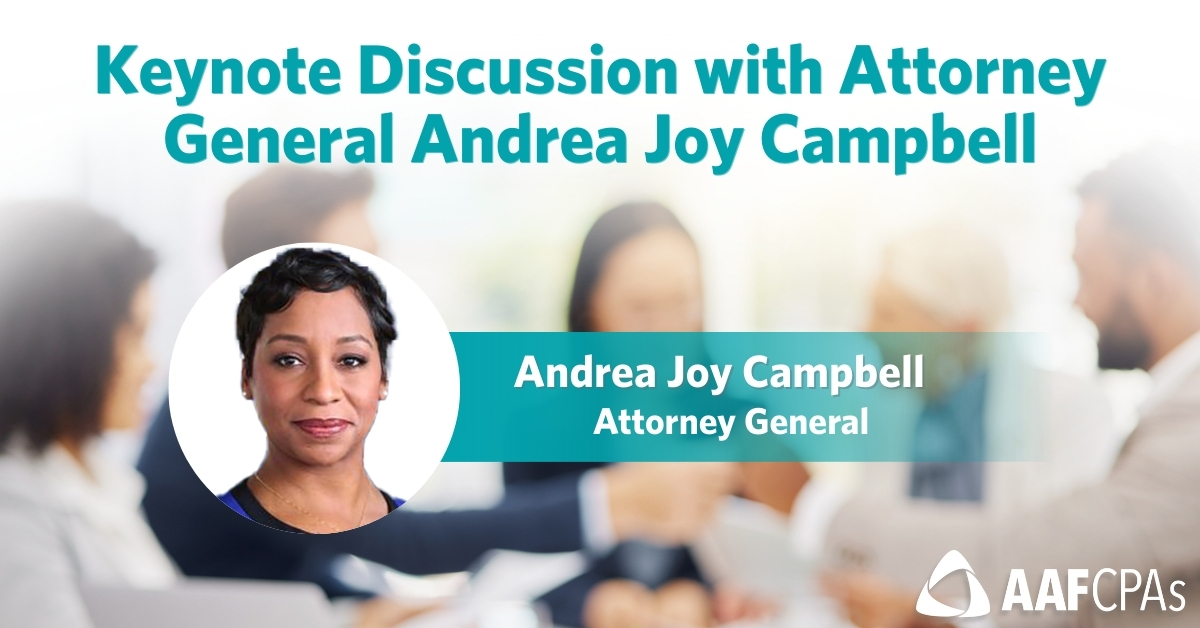

Seminar Recap: Keynote Discussion with Attorney General Andrea Joy Campbell

During AAFCPAs’ recent Nonprofit Seminar (April 2025), Massachusetts’ Attorney General Andrea Joy Campbell engaged in a question-and-answer session and shared perspectives with nonprofit leaders looking to navigate current funding and regulatory challenges. This discussion offered practical guidance for finance leaders on navigating funding complexities, ensuring compliance, and fostering collaboration to enhance organizational resilience and effectiveness. […]

Enter to Win a Ticket to BBJ’s 17th Annual CFO of the Year Awards – Limited Entries

AAFCPAs is honored to once again sponsor the Boston Business Journal’s 17th annual CFO of the Year awards program, recognizing the outstanding financial leaders who help businesses and communities thrive. We are honored to participate in this annual BBJ event, an exciting celebration of these exceptional CFOs who drive strategy, foster innovation, and ensure the […]

Cyber Insurance in 2025: What CFOs and Risk Managers Need to Know to Avoid Costly Gaps

As cyber threats evolve in both sophistication and scale, cyber insurance has moved from a niche policy consideration to a cornerstone of business continuity and enterprise risk management. For many organizations, coverage is now a condition of financing, contract renewal, or fiduciary oversight. Yet many policies still fall short, especially when the scope of coverage […]

Inside AAFCPAs’ Award-Winning Tech Strategy–Live at Accounting Today

AAFCPAs has been invited to speak at Accounting Today’s upcoming web seminar, Lessons from the Best Firms for Technology. Peter R. Sebilian, AAFCPAs’ Chief Information Officer, will represent the firm as a panelist, sharing insights on the firm’s industry leading approach to technology strategy, risk management, and innovation. Moderated by Accounting Today Technology Editor Chris […]

How to Document System Requirements Before You Choose New Software

New software opens up abundant opportunities for improvement: automated processes, streamlined workflows, system integrations, and much more. For many organizations, however, bridging the gap between current systems to new systems can be daunting. What begins as a push for efficiency can lead to frustration when the system fails to meet expectations—or worse, creates new problems. […]

Massachusetts to Automate Penalties on Late Advance Payments Starting July 2025

Beginning July 1, 2025, the Massachusetts Department of Revenue (DOR) will automatically assess penalties on businesses that fail to make required advance tax payments by the 25th of each month. The advance payment requirement, in place since 2021, applies to businesses with more than $150,000 in annual tax liability from certain indirect taxes, such as […]