AAFCPAs’ 2018 Year-End Tax Planning for Privately-Held Companies (Part 1) Webinar Now Available OnDemand

AAFCPAs’ 2018 Year-End Tax Planning for Privately-Held Companies (Part 1) Webinar, presented live on Wednesday, October 17th, is now available 24/7 via our website.

2018 Year-End Tax Planning for Privately-Held Companies (Part 1)

In 2018, tax planning is more complicated than usual. Most provisions of the massive Tax Cuts and Jobs Act (TCJA) go into effect this year, and as a result you likely will need to change at least some of your tax planning strategies.

AAFCPAs’ Partner Sorie Kaba, CPA will Present at NABA Minority Business Conference in Boston

AAFCPAs Partner Sorie Kaba, CPA will serve as a panelist on Saturday, October 20th, providing guidance on Creating a Culture of Diversity and Inclusion in the corporate environment. This session is part of The Boston Chapter of the National Association of Black Accountants’ (NABA, Inc.) Annual Minority Business Conference (AMBC), organized for the benefit of students, professionals, […]

AAFCPAs Outlines State Applicability, IRS Guidance Related to TCJA that Nonprofits Need to Know

AAFCPAs would like to make Tax Exempt Organizations aware of state by state applicability and recent IRS guidance on the Tax Cuts and Jobs Act, known officially as H.R. 1, (the “TCJA”) and how it pertains to charitable nonprofits. AAFCPAs has outlined the following applicability and guidance that are especially noteworthy: State by state applicability […]

AAFCPAs Welcomes New Partner Joyce Ripianzi to Support Steady Growth of the Firm

Boston, MA (October 16, 2018) – AAFCPAs, a best-in-class CPA and consulting firm known for assurance, tax, accounting, wealth management, valuation, business process, and IT advisory solutions, today announced the addition of a new Partner, Joyce Ripianzi, CPA. Joyce joins AAFCPAs as a key member of the firm’s growing Managed Accounting Solutions Practice. She will […]

AAFCPAs Wealth Management names new co-directors

AAFCPAs Wealth Management, a financial planner in Westborough, has named two new co-directors of the firm. Carmen Grinkis and Andrew Hammond are the new co-directors, taking over from founder Joel Aronson, the firm said.

AAFCPAs’ Tax Practice to Present TCJA “Issues Identification” Session at CMFEO Executive Breakfast

AAFCPAs Tax Practice Leaders Richard Weiner, CPA, MST, Julie Chevalier, CPA, and Joshua England, JD, LLM will present a Tax Cuts and Jobs Act educational workshop on October 16th, for the benefit of The Central Massachusetts Financial Executives Organization (CMFEO). For privately-held companies, the TCJA impacts your financial statements, operating model, liquidity, investments and capital, and people. In this […]

IRS Issues Tax Guidance on TCJA Changes on Business Expense Deductions for Meals, Entertainment

AAFCPAs would like to make clients aware that on October 3rd, 2018, the Internal Revenue Service (IRS) issued guidance on the business expense deduction for meals and entertainment following law changes in the Tax Cuts and Jobs Act (TCJA). The 2017 TCJA eliminated the deduction for any expenses related to activities generally considered entertainment, amusement […]

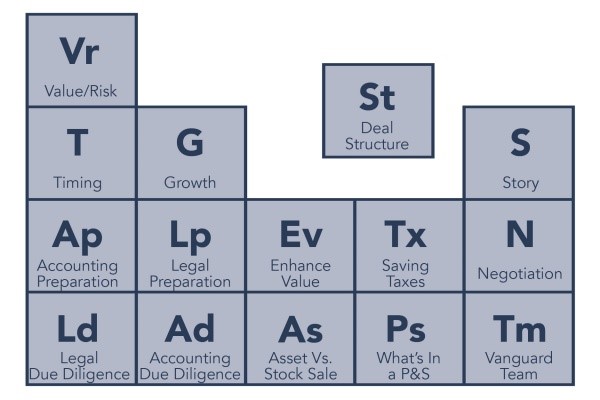

AAFCPAs’ Jack Finning and Janice O’Reilly to Present Educational Workshops on Preparing to Sell a Closely-Held Business

AAFCPAs Partners Jack Finning, CPA, CGMA and Janice O’Reilly, CPA, CGMA will present educational workshops on October 24th, providing guidance and key considerations when selling a closely-held business. These sessions are part of Beacon Equity Advisors’ annual Elements Conference, organized for the benefit of private company business owners who want to learn about: timing the […]