Joel Aronson

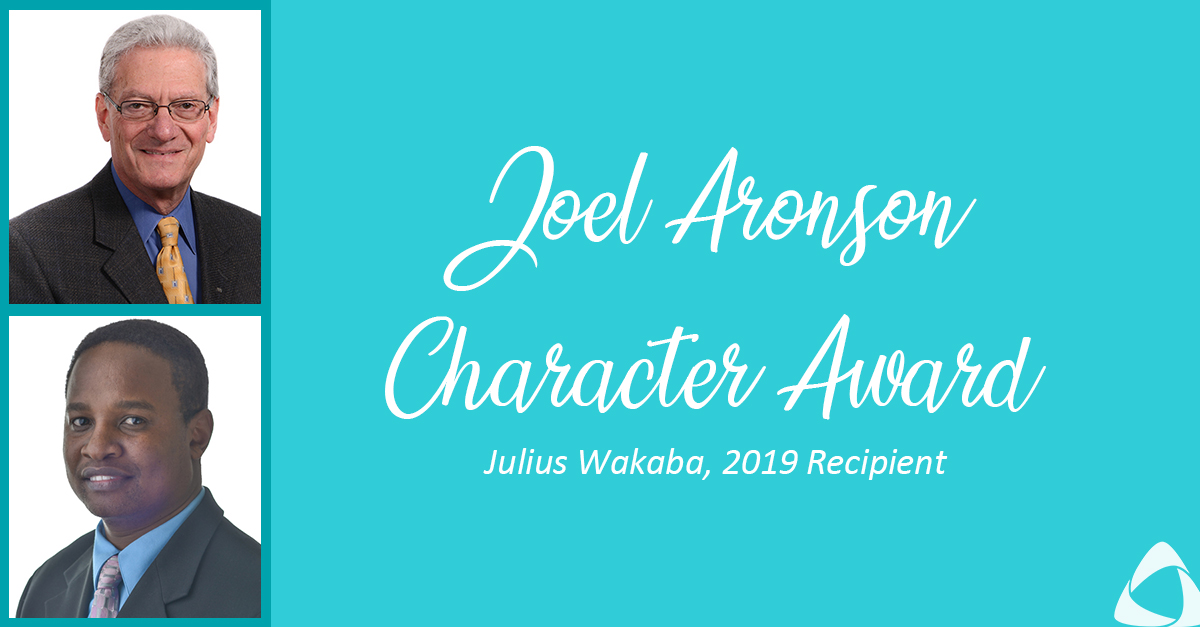

AAFCPAs Announces Joel Aronson Character Award and 1st Recipient

In recognition of the tremendously positive impact Joel has had over his 45 years of employment as Partner of AAFCPAs and Founder of AAFCPAs Wealth Management, we are honored to announce the Joel Aronson Character Award. This Award and accompanying $1000 gift will be given annually to the AAFCPAs team member who best epitomizes Joel’s […]

AAFCPAs Wealth Management names new co-directors

AAFCPAs Wealth Management, a financial planner in Westborough, has named two new co-directors of the firm. Carmen Grinkis and Andrew Hammond are the new co-directors, taking over from founder Joel Aronson, the firm said.

AAFCPAs Wealth Management Announces Transition of Leadership

AAFCPAs Wealth Management is pleased to announce a transition in leadership, naming Carmen Grinkis, PhD, CLTC, CFP® and Andrew Hammond, CFP® as Co-Directors. Grinkis and Hammond are both Senior Wealth Advisors at AAFCPAs and have been poised to take over the leadership from Founder and Wealth Advisor Joel Aronson, CPA, MBA, PFS since joining the […]

Financial and Estate Planning Opportunities Related to the New Tax Law

The Tax Cuts and Jobs Act (“The Act”) reflects a widespread change not seen in over 30 years. The architects of the legislation hoped this tax overhaul would allow a simplification of the US tax code. Unfortunately, what is clear since the bill’s signing is the additional complexity, and most provisions have taken effect immediately […]

AAFCPAs Wealth Management Shares Proactive Strategies for Investors in a Strong Market

AAFCPAs Wealth Management is constantly reviewing market conditions to be thoughtful, disciplined, and opportunistic to changes that occur over time. Market volatility is not something you can control, but how you position yourself now will have a lasting impact. The US financial market is strong. Rejoice! The bull market continues for the past eight years […]

Cyber Security: Keep Your Online Accounts Safe

Cyber fraud continues to escalate and evolve, and security requires vigilance. We would like to remind you that your entire organization must learn and adapt over time. AAFCPAs Wealth Management, an affiliate of AAFCPAs, has provided a summary of some of the threats of significant concern in 2017 used to steal identity and login credentials. After gaining […]

The Bucket System: Managing Your Assets in the Face of Volatility

Nonprofit World Magazine – Joel Aronson, wealth advisor, AAFCPAs Wealth Management provides members of the national Society for Nonprofits (subscriber content) with insight into a simple system that is key to financial stability. As a nonprofit leader, you’re no stranger to cash flow crunches. But you can attain a new level of stability if you persevere […]

AAFCPAs Wealth Management Invests in Team and Processes in 2016

AAFCPAs Wealth Management is pleased to share the investments we have made in our team and processes in 2016, designed to enhance your client experience: AAFCPAs Wealth Management is firmly dedicated to servicing our clients and enhancing your financial wellbeing. Ultimately, we believe it is our 1) diversity of talent from our team, 2) four […]

AAFCPAs Wealth Management Update: Election Results

The end result of a polarizing presidential race certainly rocked the boat called Wall Street this week. The markets responded as they almost always do when Uncertainty Rules – they proceeded to quake and quiver. As we have seen repeated in history, for example: 9-11, and Brexit, unexpected, contentious events often cause overreaction from investors. […]