Tax Relief and Incentives for Affected Cannabis Businesses

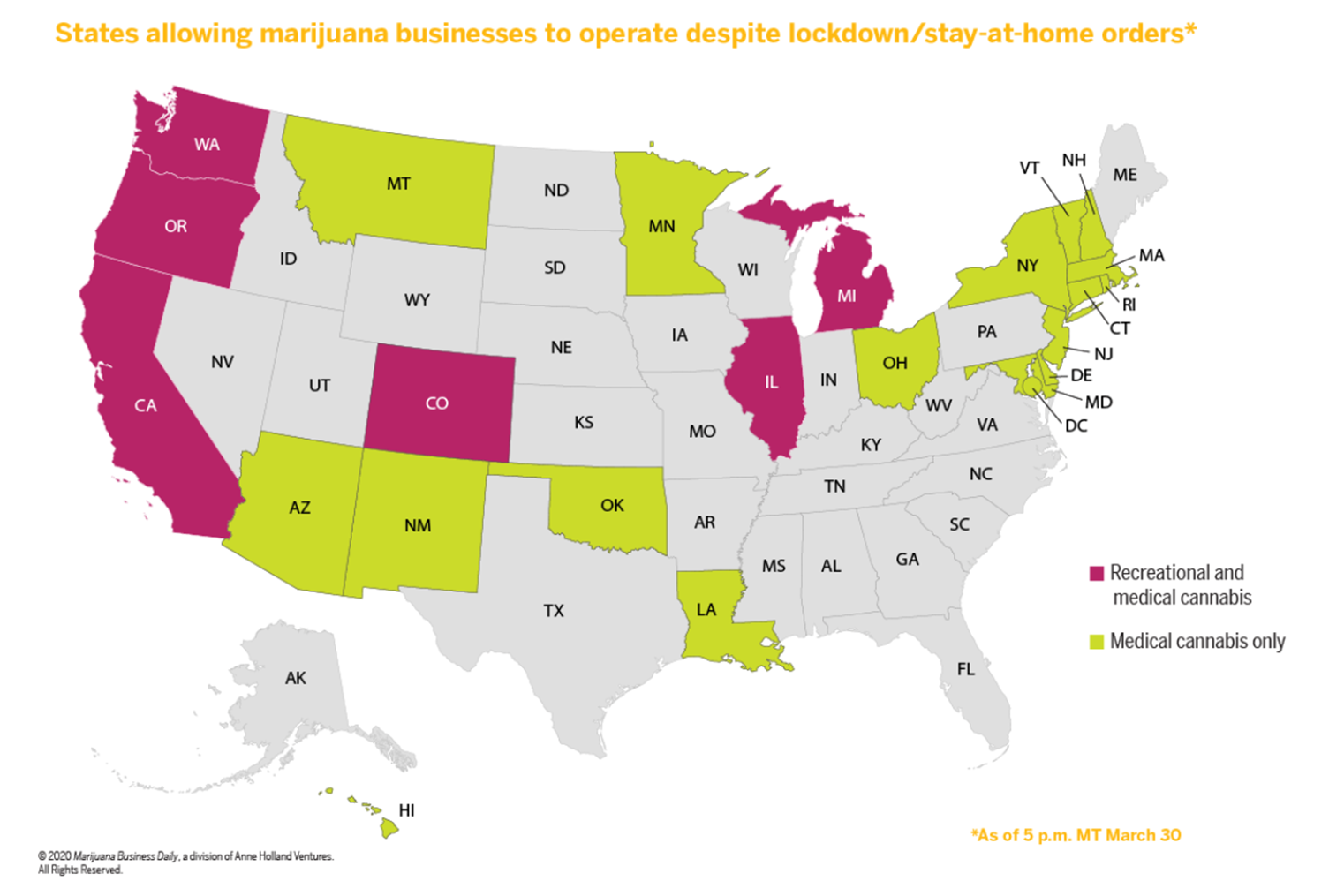

The quickly spreading coronavirus, and the subsequent response from states to close all “non-essential” businesses, is causing much confusion for the Cannabis industry. The decision about whether cannabis operators can keep doing business has occurred state by state, and in some cases, city by city.

The majority of US states that have closed non-essential businesses have exempted medical cannabis industries from the closures, reports MJBizDaily.

AAFCPAs has provided the following guidance for cannabis clients on the federal tax relief and incentives available to assist with the economic impact of COVID-19. We advise clients to contact their AAFCPAs partner to discuss the following items, as well as other federal and state relief provisions.

Regulatory Update

On March 23, 2020, Massachusetts became the seventh state to limit cannabis operations to medical cannabis only, in response to the Coronavirus pandemic.

Image Source: MJBizDaily

The Massachusetts Cannabis Control Commission (CCC) issued a Cease and Desist Order in compliance with Massachusetts’ COVID-19 Order #13: Assuring Continued Operations of Essential Services in the Commonwealth, Closing Certain Workplaces, and Prohibiting Gatherings of More than 10 people.

The order places a two week suspension, from 12pm on March 24th through 12pm April 7th, on adult-use operations, excluding maintaining cultivation operations for existing plants and security operations. Medical marijuana operations have been deemed essential, and thus are permitted to continue operations.

Fortunately, the CCC will continue to review license applications and conduct related inspections.

Income Tax Relief

Following the declaration of COVID-19 as a national emergency, on March 20th, 2020 Treasury Secretary Steven Mnuchin announced (in Notice 2020-18) that the IRS will move the national income tax filing day ahead to July 15th, three months after the normal deadline for Americans to send in their returns. The filing deadline now coincides with the federal tax payment deadline (2019 tax due and Q1 2020 estimated tax due) that was extended by the Treasury on Tuesday, March 17th (Notice 2020-17). Additionally, the March 20th announcement removed previous aggregate limits communicated in the March 17th notice.

Though we are working remotely for the most part, AAFCPAs continues to provide tax preparation and planning services to clients.

Payroll Tax Incentives

The Families First Coronavirus Response Act, signed into law March 16th, provides emergency family and medical paid leave, emergency paid sick leave, federal payroll tax credits, and an exclusion from employer FICA tax with respect to the related paid leave to enable employers with less than 500 employees to keep their workers on payroll while ensuring that these workers are not forced to choose between paychecks and public health measures related to COVID-19. There are special rules, including exemptions, for employers with less than 50 employees.

Although the IRS’ position is uncertain, we believe the payroll tax credits are available to cannabis clients and we advise clients to reach out to their AAFCPAs Tax Partner for guidance.

The payroll tax credits are refundable and consist of a credit for paid family leave and a credit for paid sick leave. Although the payroll tax credit is designed to fully offset the eligible wages, the amount of the tax credit claimed is required to be included in gross income for income tax purposes. Further, the employer cost of maintaining a group health plan applicable to the eligible wages is available for the credit. The below table presents a general summary of the eligible leave, eligible pay, and related tax credits that should be considered in coordination with your particular facts and circumstances.

|

Paid Family Leave |

Paid Sick Leave | |

|

Eligible Leave |

Public health emergency leave under the FMLA when an employee is unable to work or telework because the school or place of care has been closed or the childcare provider is unavailable due to a public health emergency related to COVID-19. |

Up to 80 hours of paid sick leave is required. The required amount depends on the virus-related reason. The three reasons are: (1) the employee leaves due to quarantine or self-quarantine or having COVID-19 (2) the employee is caring for someone described in (1) above (3) the employee is caring for children whose school has been closed because of COVID-19 precautions. |

|

Eligible Wages |

The first 10 days of leave may be unpaid. Thereafter, 2/3 of an employee’s regular pay, up to $200 per day, is required. |

The pay depends on the virus-related reason. If reason (1) then 100% of an employee’s regular pay, up to $511 per day. If reason (2) or (3), then 2/3 of an employee’s regular pay, up to $200 per day. |

|

Payroll Tax Credit |

Eligible wages paid from April 1, 2020 through December 31, 2020 and up to the daily and maximum per-employee limits Daily limit – $200 Maximum – $10,000 |

Eligible wages paid from April 1, 2020 through December 31, 2020 and up to the daily, quarterly and maximum per-employee limits Daily limit – $511 per day for scenario (1) above; otherwise, $200 per day Quarterly limit – 10 hours Maximum limit – 80 hours |

AAFCPAs’ Cannabis Practice will continue to monitor legislative and regulatory changes, and we will keep you informed as changes occur or become clarified.

If you have questions, please contact: David McManus, CPA, CGMA, Co-Managing Partner, at 774.512.4014, dmcmanus@nullaafcpa.com; or your AAFCPAs Partner.