David Gravel

Massachusetts to Automate Penalties on Late Advance Payments Starting July 2025

Beginning July 1, 2025, the Massachusetts Department of Revenue (DOR) will automatically assess penalties on businesses that fail to make required advance tax payments by the 25th of each month. The advance payment requirement, in place since 2021, applies to businesses with more than $150,000 in annual tax liability from certain indirect taxes, such as […]

David Gravel on SumNews Spring 2025

Our Cannabis Committee meets quarterly to discuss legal and technical changes and accounting policies that impact the cannabis and hemp industries. We spoke with the committee’s new co-chair David Gravel, CPA, MPAc, tax director at AAFCPAs, about his decision to lead, his vision for the committee and key industry trends. What inspired you to take […]

Webinar Recap: Tax Planning for Cannabis Operators

In this article: Navigating the cannabis industry’s complex tax landscape may feel overwhelming, especially given ongoing challenges like Section 280E and potential rescheduling. However, with the right strategies, you can reduce your tax burden, optimize cash flow, and position your brand for growth. AAFCPAs’ 2024 Cannabis Tax Update Webinar, speakers provided valuable insights on overcoming […]

Secure Your 2024 Tax Savings – Watch Our Cannabis Tax Webinar

Webinar: Tax Planning for Cannabis Operators AAFCPAs invites you to watch our 2024 Tax Planning for Cannabis Operators webinar. This session is designed to help cannabis business owners navigate the complexities of 280E and maximize tax efficiency. Details: Explore tax considerations unique to the cannabis industry, including the ‘taxing’ 280E, with guidance on navigating regulations […]

Year-End Tax Webinars: Optimize Your 2024 Tax Strategy

Watch OnDemand: 2024 Year-End Tax Webinars Reviewing your tax strategies before the end of the calendar year is essential to uncover potential tax savings, ensure compliance, and optimize your financial decisions, which is why AAFCPAs annually hosts a series of complimentary webinars to help clients stay informed and prepared. Whether you are a business owner, […]

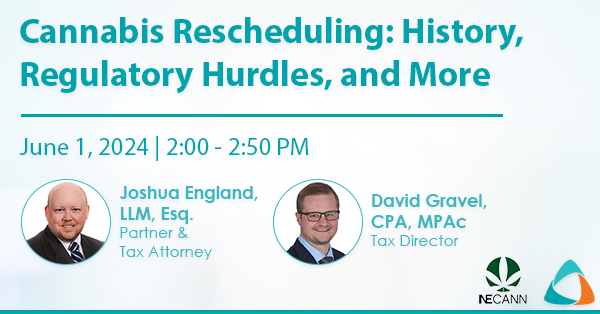

AAFCPAs Presented at Illinois Cannabis Convention

AAFCPAs’ Joshua England, LLM, Esq. and David Gravel, CPA, MPAc were invited to present on “Cannabis Rescheduling: History, Regulatory Hurdles, and Operator Impact Expectations” at NECANN’s Illinois Cannabis Convention & Expo, May 31 – June 1, 2024 in Chicago. This session dove into cannabis rescheduling, its historical context, regulatory hurdles, and the potential impact on […]

TerrAscend Corp. Joins Other Operators Changing 280E Tax Position

AAFCPAs would like to make cannabis clients aware that TerrAscend Corp., in its fourth-quarter earnings call, announced it would no longer be making tax payments under Section 280E of the Internal Revenue Code. The company’s Chief Financial Officer noted its legal basis in doing so comes from a legal interpretation based on a similar position […]

Watch Now: Cannabis Tax Webinar 11/7

As we approach the conclusion of 2023, the Cannabis Practice at AAFCPAs extends a warm invitation to our esteemed clients and friends to proactively evaluate their comprehensive financial status in anticipation of strategic year-end tax planning. Please remember, implementing the majority of tax-saving strategies necessitates action on or before December 31. At AAFCPAs, we stand […]

AAFCPAs Featured at VT Cannabis Convention

AAFCPAs Cannabis Practice Leaders have been invited to speak at The Vermont Cannabis and Hemp Convention hosted by the New England Cannabis Convention (NECANN) on Saturday, May 6, 2023 at the Champlain Valley Expo in Burlington, Vermont. WHAT NEW OPERATORS NEED TO KNOW THAT THOSE IN MATURE MARKETS HAD TO FIGURE OUT THE HARD WAY! […]