Inflationary Pressures on the Decline

Over the past two weeks, economic data have pointed to what may be a change in the stifling inflationary pressures we’ve become accustomed to over the past 2 years.

CONSUMER PRICE INDEX RELEASE LEADS TO OPTIMISM…

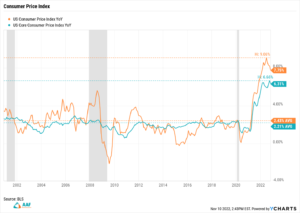

Last Thursday’s release of the Consumer Price Index (CPI) readings from the Bureau of Labor and Statistics (BLS) noted a positive surprise, as inflationary pressures exhibited signs of moderation on both the month over month (MoM) and year or year (YoY) timeframes.

MoM inflation registered the same reading that was recorded in September (0.4% increase), while the YoY data showed a 7.7% increase. While still high on a relative basis, this price level represented a significantly lower reading than what had been priced into the markets (~8.0%) and is cause for some enthusiasm.

Stocks responded favorably as the data led investors to believe this apparent “cooling off” of inflationary impulses will allow the Federal Reserve’s Open Market Committee (FOMC) to “pivot” from their current hawkish stance to a more accommodative posture sooner than later.

As of the end of last week, the market was pricing an 80% probability of a 50bps (0.5%) increase in the Federal Funds Rate at the FOMC’s next meeting in mid-December. Prior to the release, it was largely believed that a 75bps increase was all but guaranteed the next time the FOMC acted.

…AND PRODUCER PRICE INDEX DATA FURTHER BOLSTERS THE CPI RELEASE

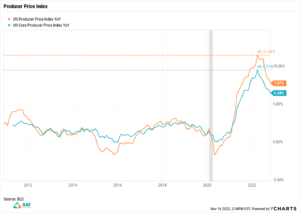

In similar fashion to the CPI data, the Core Producer Price Index (PPI) also shocked investors on Tuesday of this week as MoM readings were unchanged from September’s release, and YoY figures (6.7%) came in lower than the estimated 7.2% threshold.

Unlike CPI which provides a glimpse into what consumers experience when buying goods and services, PPI measures the price change from the perspective of the seller. Taking a combined view of both data sets provides for a more comprehensive approach to understanding both leading and lagging indicators that affect the country’s’ economic health.

WHY ARE THESE FIGURES IMPORTANT?

Inflation is one of the biggest concerns in today’s economy, as the overall price of goods and services has reached levels not witnessed in several decades.

Per the chart below, both overall CPI and “Core” CPI, which excludes food and energy, are three times as high as anytime we’ve seen since November 2000. Higher levels of inflation are concerning because higher costs of living usually lead to recessions, which are noted by the vertical gray bars on the chart.

While the data for PPI doesn’t extend as far back as what we can track with CPI, the chart below tells a similar story, as cost inputs ultimately find their way into pricing pressures that consumers absorb:

As investors begin to digest and interpret the meaning of these two reports, it’s worth noting that we might well have seen the high-water mark for inflationary pressures, and therefore the possibility that costs of living may start to moderate. While two months of data sets only present but a small sample size, there is renewed hope that Federal Reserve’s current and cumulative actions to date may in fact lead to a “softer” landing than had once been expected.

UP NEXT

All eyes will be on the next Consumer Confidence Index release on Tuesday, November 29th to see how Americans feel about the state of things. As important as the actual numbers may be, our impression of the data is equally important as perception is largely reality. This monthly report, produced by The Conference Board, details consumer attitudes and expectations for inflation, stock prices and interest rates.

As always, we encourage our clients to reach out to their AAF Wealth Management Wealth Advisor with questions or concerns.

AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.