AAF Wealth Management Q2 2022 Market Update

“You may not control all the events that happen to you, but you can decide not to be reduced by them.” – Maya Angelou

And just like that, we turn the page on another quarter in the markets. Let’s be honest: we can’t turn the page quick enough given the Q1-2 market performance. While stock market weakness and inflation have garnered most of the headlines this year, the bond market has quietly put up some extraordinary numbers as well, as we’re on track for the worst year in fixed income returns since 1865. Yes, you read that right, since the year the Civil War ended!

Many investors quip they’re ready to put 2022 in the rear view and speed away. We all know, however, running from problems rarely works out. We must realize and accept the fact that markets go through seasons of rebirth, maturation, and decline. In economic speak, we refer to this process of expansion and contraction as the business cycle. While we would love to simply skip past the “declining” stage of this process, it is not an option. The natural course of the economic cycle will continue regardless of attempts to intervene.

What we can control, however, is how we choose to respond.

Financial Planning Revisited

During periods of market stress and economic uncertainty, one of the easiest ways to alleviate anxiety is to revisit your financial plan. Rerunning projections based upon current figures (assets, liabilities, and income) may go a long way toward setting minds at ease, as the math that underpins the plan will “show you the way.”

AAF Wealth Management’s Personal Financial Planning clients know the rigor we put into this endeavor. We take financial planning very seriously because it provides an estimate of where your financial journey will lead as well as the ability to model “what if” scenarios.

Income, Expenses & Asset Drawdowns

Obviously, accuracy when estimating income and expenses is the most important aspect driving successful financial plans.

Historical records of tax returns, W2s, and dividend & capital gains distributions can have a material effect on the outcome of a financial plan. Understanding where collateral sources of income come from can provide a big impact on the output of total net worth.

What we are distinguishing here is a full breakout of income sources, as opposed to lump-summing all of your income as a single line item. As an example, we often find clients who hold dividend & capital gain paying securities in non-retirement accounts, and more tax-efficient investments in tax-sheltered locations. Through in-depth analysis and projections, we are able to show what additional tax savings may result from years of savings allocated within a more tax-efficient regime.

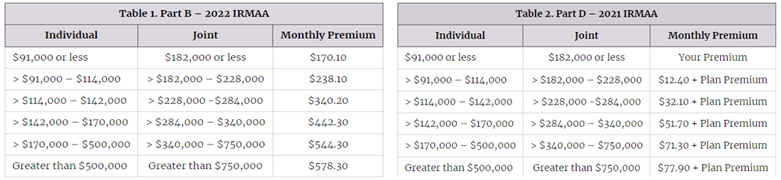

Example: IRMAA (Income Related Monthly Adjustment Amount) on Medicare Part B & D Premiums

While we would all like to earn as much as possible in retirement, there are potential pitfalls if not done in the most efficient manner. Monthly premiums for Medicare Parts B & D can increase several hundred percent based upon the level of reported income on 1040 tax returns:

Source: https://www.irmaasolutions.com/do-capital-gains-affect-irmaa

Ultimately, the savings of a few hundred, to a few thousand dollars per year, over the course of multiple decades can amount to significantly more money in your control. With inflation currently at the highest levels we’ve seen in 40+ years (i.e., 9.1% through June), any savings will benefit your long-term plan.

A detailed review of your monthly budget (as opposed to broadly estimating expenses) may also help ensure investment assets last for your lifetime. Most retirees assume that once they enter the realm of retirement, expenses are in “set it and forget it” mode. On the contrary, detailed annual reviews of expenses are one of the most important tasks a retiree can undertake.

One of the key differences that a good financial plan can provide its owner is in demonstrating how to allocate various income streams with different types of expenses. This is why AAF Wealth Management advises clients to distinguish between required and discretionary expenses. Identifying and assigning which income streams are dedicated toward required expenses (e.g., food, shelter, insurance) and those dedicated to discretionary expenses (e.g., vacations, hobbies) can be very useful in helping to structure and manage investments.

With the difference delineated between these two categories of expenses, a detailed financial plan can extrapolate the differences in financial asset values over time, assuming increases and decreases in the level of discretionary expenses may be adjusted commensurately with rises and falls in investment values. As a rule of thumb, if an individual relies upon their investments for income, and the market has reduced the value of those investments, adjustments in withdrawals made from those assets should be made to ensure they aren’t drawn down prematurely.

What If Scenarios

Strategies to mitigate taxes and prevent over-leveraging of assets are effective responses in difficult market environments, but there are other positive planning techniques if your asset values have fallen.

ROTH Conversions are worth exploring to capitalize on reduced account values, while simultaneously reducing the tax impact long term. A ROTH Conversion transitions assets from a traditional IRA to a tax-free retirement vehicle (ROTH IRA). The conversion itself is a taxable event in the year in which it’s accomplished, but there are several reasons why some may want to model this type of move into their financial plan.

A ROTH Conversion puts more control in your hands later in life. As you may know, the IRS generally requires retirement account owners to begin withdrawing assets from their tax deferred retirement vehicles at age 72. By affecting a ROTH Conversion from an IRA in advance of that timeframe, the actual amount of the “Required Minimum Distribution” can potentially be lowered. As such, you now have control over how much and when to withdraw income. Additionally, there are estate planning benefits to consider for leaving ROTH account assets to beneficiaries.

Breathe and Trust The Cycle

AAF Wealth Management reminds investors to control what you can control, and focus your energy in the right places. Get outside, unplug, step away from screens and investment statements, and focus on the things that really matter in life: family, friends, and health.

Difficult times can be a test of our souls, and as such can be some of the most instructive times possible.

The economic news may seem dire, but very few economists and even fewer financial pundits get the projections correct.

AAF Wealth Management remains by our clients’ side in their financial journey: from managing money and providing peace of mind, to helping you achieve your goals and ultimately fulfillment!

AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.