Events

Accounting Standards Update 2025

During AAFCPAs’ recent Nonprofit Seminar (April 2025), Matthew Hutt, CPA, CGMA, Partner, and Jennifer A. L’Heureux, CPA, Manager, shared insights with more than 550 attendees on recent developments in accounting standards affecting nonprofit organizations. Nonprofits must stay ahead of evolving accounting rules to keep their funding secure and their reporting accurate. While 2025 brings fewer […]

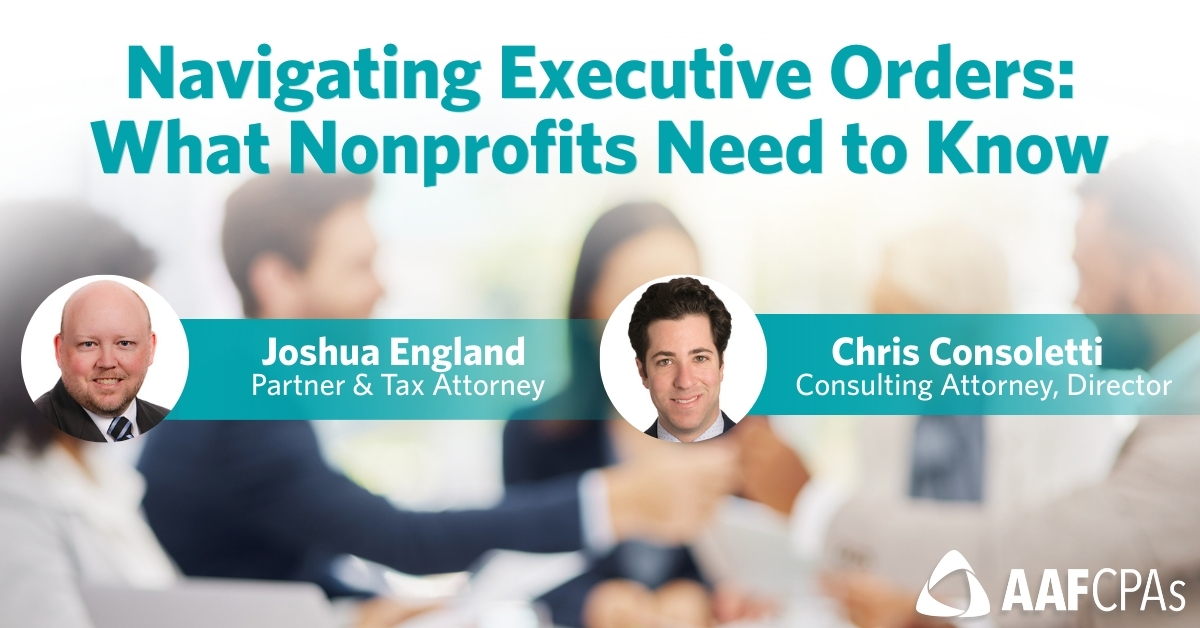

Seminar Recap: Navigating EOs: What Nonprofits Need to Know

Navigating Executive Orders: What Nonprofits Need to Know | Webinar On-Demand During AAFCPAs’ recent Nonprofit Seminar (April 2025), AAFCPAs’ consulting attorneys Joshua England and Chris Consoletti presented practical guidance on how executive orders may affect nonprofit operations to more than 550 attendees. A reality for many nonprofits is that they are already attempting to navigate […]

Ryan Wolff Presented on Innovation Strategy and Technology Adoption at CwX 2025

AAFCPAs was featured at CwX 2025, where Ryan Wolff, MBA, a leader of Strategic Innovation & Data Analytics, joined a panel focused on advancing firmwide technology adoption. Hosted by Rob Brown, co-founder of the Accounting Influencers Roundtable, the session brought together leaders who are driving change in how firms adopt and scale emerging tools. In this […]

AAFCPAs’ Rich Weiner Presented on M&A Deal Strategy: Pre-Transaction Planning to Post-Closing Integration – MCLE Webcast May 8, 2025

AAFCPAs’ Richard Weiner, CPA, MST, CM&AA, Tax Partner spoke at a live webcast—Counseling Clients Through an M&A Deal: Pre-transaction considerations to post-transaction integration—hosted by MCLE New England. During this program, Rich offered guidance for legal counsel and all other members of a deal team, such as M&A attorneys, brokers/investment bankers, estate planners, and financial advisors, […]

Flood Shared Leadership Insights at San Diego Firm Growth Forum – May 21, 2025

AAFCPAs’ Destiny J. Flood, CPA, Commercial Partner, Outsourced Accounting & Fractional CFO joined a panel discussion on the evolving role of CPA firm partners at Accounting Today’s Firm Growth Forum. This session, Next-Gen Perspectives: Insights from Newly Minted Partners, highlighted the journeys of new partners, their motivations for leadership, and how they are shaping the […]

Flood Nominated for CPA Experienced Leader, 2025 CalCPA Women to Watch Awards

AAFCPAs is pleased to announce that Destiny J. Flood, CPA, Commercial Partner, Outsourced Accounting & Fractional CFO has been nominated for CPA Experienced Leader at the 2025 CalCPA Women to Watch Awards presented at the 2025 Elevate: Women’s Leadership Forum. This recognition highlights her exceptional leadership, dedication to the profession, and contributions to the success […]

FQHCs: Navigating Financial and Operational Challenges Amid Federal Funding Uncertainty

AAFCPAs’ Matthew Hutt, Vassilis Kontoglis, and Ryan K. Wolff offered insights in an educational session titled Navigating Financial & Operational Challenges in FQHCs at CHI 2025! This session was ideal for health center CFOs, COOs, and other decision-makers looking to adapt to the current federal and state funding landscape. In this session, attendees explored how […]

A full day of educational insights to help nonprofits thrive!

Mark your calendars for AAFCPAs’ 2025 Annual Nonprofit Seminar, a full-day virtual event that delivers practical strategies to help nonprofit leaders and finance professionals navigate current challenges, optimize operations, and drive long-term success within your organization. During the seminar, you will: Save The Date What: AAFCPAs’ Annual Nonprofit Seminar When: April 30, 2025 | 8:45 am – 3 […]

Webinar On-Demand – Budget With Efficiency!

Webinar: Streamline budgeting, forecasting, and reporting with Martus™ Are you tired of the time-consuming and frustrating annual budgeting process? AAFCPAs helps clients streamline budgeting, forecasting, and reporting with Martus™, an easy-to-use and affordable cloud-based software. Webinar Highlights Webinar OnDemand Why Watch? AAFCPAs helps clients ditch the spreadsheets and budget better! Budget in minutes, not months.