Businesses May Defer Social Security Tax Up Until PPP Loan is Forgiven

UPDATED 6.5.2020: On June 5, 2020, the President signed into effect the Paycheck Protection Program (PPP) Flexibility Act, which would provide greater flexibility in how businesses may spend PPP loan proceeds. This includes allowing businesses participating in the PPP loan to defer social security taxes without limitation. The purpose of PPP and the payroll tax deferment was to provide businesses with capital to weather the crisis. Delay of payment of employer payroll taxes and receiving the PPP loan should not be considered double-dipping.

Read more about the PPP Flexibility Act. >>

Prior to the passing of the PPP Flexibility Act, the below guidance was in effect.

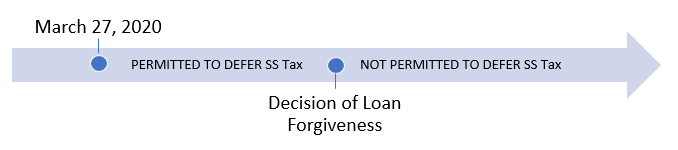

ORIGINAL POST 4.28.2020: The AAFCPAs would like to make clients aware that the IRS recently released answers to Frequently Asked Questions on the deferral of employment tax deposits as provided by Section 2302 of the CARES Act. These FAQs make clear that “employers who received a paycheck protection program (PPP) loan may not defer the deposit and payment of the employer’s share of Social Security tax that is otherwise due AFTER the employer received a decision from the lender that the loan was forgiven.” In other words, businesses who receive PPP loans may defer social security tax payments (6.2%) up until the point in time you receive the decision that your loan is forgiven.

This deferral began on March 27, 2020 and will continue through the date the lender issues a decision to forgive the loan in accordance with paragraph (g) of Section 1106 of the CARES Act. There will be no penalties for failure to deposit or failure to pay up until such date the decision is received.

This will serve to relieve employers of most of the burden of paying payroll taxes during the 8-week period given to spend the funds received from a PPP loan, as the debt forgiveness won’t take place until after that period has concluded.

This is a significant update from the original program, which seemed to indicate that those receiving PPP funds could not participate in the deferral program. AAFCPAs advises clients to contact your payroll provider to start taking advantage of this benefit.

Learn more about the Payroll Tax Credit and Other COVID-19 Payroll-Related Benefits >>

If you have any questions please contact dmcmanus@nullaafcpa.com; or your AAFCPAs Partner.