Health Center Cost Reports Extended by CHIA and CMS

AAFCPAs would like to make Community Health Center (CHC) clients aware that due to recent events surrounding COVID-19, the Centers for Medicare and Medicaid Services (CMS) and the Center for Health Information and Analysis (CHIA) have both announced deadline extensions for 2019 cost reports.

CMS Announces Extension for Specific 2019 Fiscal Year End Cost Reports

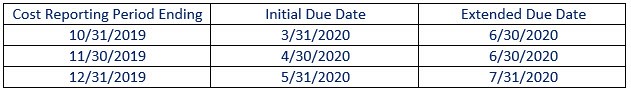

CMS has granted an automatic extension for Medicare Cost Report filing for all providers with specific 2019 fiscal year ends. The following is a summary of the fiscal year ends and their extended due dates:

2019 Medicare Cost Report Instructions are available on the CMS website at https://www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/Paper-Based-Manuals-Items/CMS021935

Get your PS&R Reports now at https://www.ngsmedicare.com/ngs/portal/ngsmedicare/PSR

CHIA Announces Extension for Fiscal Year 2019 Cost Reports until August 3, 2020

CHIA has granted an automatic 90 day extension for all CHC Cost Reports. All CHCs, regardless of Fiscal Year End date, are now required to file their fiscal year 2019 cost report by August 3, 2020.

2019 Community Health Center Cost Report Instructions and INET Instructions are available on the CHIA website at https://www.chiamass.gov/community-health-center-cost-reports-2.

AAFCPAs’ Cost Report Expertise

AAFCPAs is deeply familiar with the instructions and the most beneficial ways to minimize the effort necessary to prepare, while maximizing reporting to properly reflect your true cost of care. We understand the key objectives of the cost reports and critical areas of focus. We are regularly called upon by the Massachusetts League of Community Health Centers to provide guidance. Because we serve the vast majority of CHCs in the state, we are able to ensure consistency of costs with peers to avoid outliers. Additionally, our close and respectful working relationship with CHIA aids in our research of complex matters.

If you need any guidance or assistance in preparing your cost reports, please let us know.

If you have any questions, please contact Pauline Legor, CPA, MBA, at 774.512.4158, plegor@nullaafcpa.com; Courtney McFarland, CPA, MSA at 774.512.4051, cmcfarland@nullaafcpa.com; or your AAFCPAs Partner.