Tax Cuts and Jobs Act: Opportunity Funds Target a New Pool of Investors to Affordable Housing Projects

AAFCPAs would like to make clients aware that The Tax Cuts and Job Act (TCJA) created a new investment vehicle known as “Opportunity Funds,” which could potentially target a new pool of investors to affordable housing projects. To benefit from this newly developed program, the project must be in a Qualified Opportunity Zone approved by the U.S. Department of Treasury, which reside primarily in economically distressed areas.

Opportunity Funds will provide new tax incentives to investors such as:

- Tax deferral of capital gains for individuals and corporations until the earlier of the disposition of the investment vehicle or December 31, 2026.

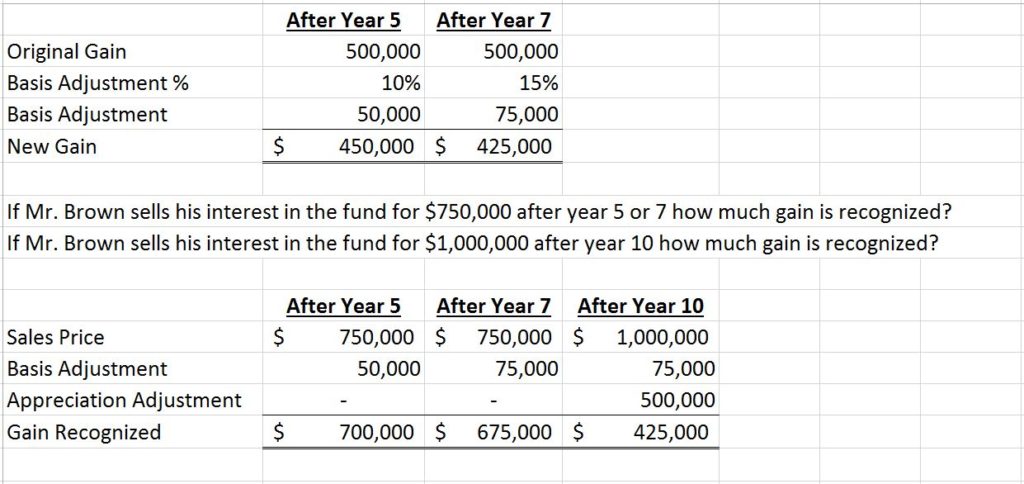

- Reduction of capital gain realized through basis adjustments of original capital gain. After year 5 and 7, the taxpayer’s basis is increased by 10% and 15%, respectively, of the original capital gain.

- After 10 years, 100% elimination of the potential additional capital gain for the project funds appreciation.

AAFCPAs has provided an example below:

XYZ Limited Partnership qualifies as an Opportunity Fund. Mr. Brown sold stock and realized a capital gain of $500,000. Subsequent to selling his stock, Mr. Brown invested the capital gain (not proceeds) into XYZ Limited Partnership. If Mr. Brown sold his interest after year 5, his capital gain on the original investment would be reduced by $50,000. If sold after year 7, his capital gain would be reduced by $75,000. In addition, any appreciation of his interest in the fund is subject to capital gain tax subsequent to the sale. If Mr. Brown is still holding his interest in the fund at December 31, 2026, he will recognize a gain of $425,000 rather than $500,000. In addition, if the investment in XYZ Limited Partnership is held for 10 years, any investment appreciation from the fund is not taxed. This can result in significant tax savings for the individual or corporation who made the initial investment. See illustration below.

If you have any questions, please contact Matthew McGinnis, CPA at mmcginnis@nullaafcpa.com, 774.512.4080; Matthew Troiano, CPA at mtroiano@nullaafcpa.com, 774.512.4022; or your AAFCPAs Partner.