Business Process Optimization

Seminar Recap: Strategic Software Add-Ons to Streamline Operations

During AAFCPAs’ recent Nonprofit Seminar (April 2025), Robyn Leet and Stuart Karas of AAFCPAs’ Business Process & IT Consulting practice presented strategic considerations for nonprofit finance leaders looking to improve efficiency, automate painful manual operations, reduce duplication, and make better use of their existing software tools. Nonprofits often rely on a patchwork of systems—some modern, […]

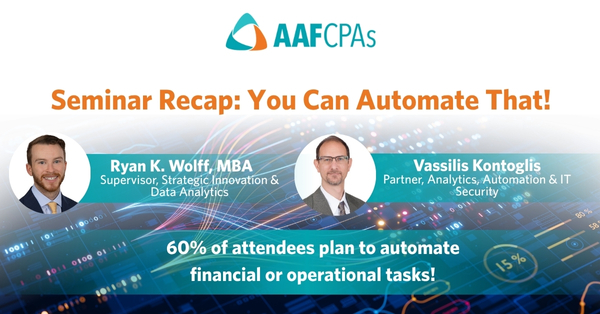

Seminar Recap: You Can Automate That!

During AAFCPAs’ recent Nonprofit Seminar (April 2025), Ryan K. Wolff, MBA and Vassilis Kontoglis presented practical guidance to more than 550 attendees on how nonprofit finance teams are using automation and artificial intelligence to eliminate repetitive tasks, streamline operations, and accelerate digital transformation. Nonprofits are under pressure to do more with less, but the path […]

AI Chatbots and Deepfake Awareness: Navigating Risks and Training Your Team

During AAFCPAs’ recent Nonprofit Seminar (April 2025), Ryan K. Wolff, MBA and Vassilis Kontoglis presented practical guidance to more than 550 attendees on the responsible use of AI tools in the workplace including risk mitigation strategies, security policy considerations, and how to recognize and respond to deepfake threats. This article offers select takeaways for nonprofit […]

AAFCPAs Named One of The 2025 Best Firms for Technology

Boston, MA (May 22, 2025)—AAFCPAs, a U.S. Top 100 CPA and consulting firm, is pleased to announce it has been named one of The 2025 Best Firms for Technology by Accounting Today. This prestigious recognition highlights the firm’s commitment to leveraging cutting-edge technology to enhance end-to-end services under one roof and improve operational efficiency and […]

Avoiding Costly Mistakes in Software Implementation

The Key to Successful Software Implementation is Careful Planning Implementing new software offers more than just a chance to update systems; it’s an opportunity to refine how your organization operates. While the drive to launch quickly may seem appealing, rushing the process can lead to missed opportunities, inefficiencies, and even long-term complications. A deliberate and […]

Improving Budgeting Processes with Cloud-Based Tools

During AAFCPAs’ recent webinar, nearly 70 attendees joined AAFCPAs and Martus™ to discuss ways to streamline the budgeting process with the Martus cloud-based solution, which enhances financial planning and decision-making. AAFCPAs’ Robyn Leet, Partner, Business Process Assessments & Attestations and Wendy Smith, CPA, Consulting CFO, Process & Systems along with Martus’ Chris Grady and Joseph […]

A Better Way to Track Representative Payee Services

For health organizations providing representative payee services, tracking expenses can be time-consuming, particularly when managing hundreds or thousands of client transactions and bank accounts. Many organizations rely on spreadsheets, which are risky, difficult to maintain, and lack real-time visibility. Month-end allocations and reconciliations further complicate client accounting and timely reporting. As a result, managers may […]

The Role of Internal Controls in Effective Risk Management

Internal controls—or the policies, procedures, and systems that safeguard assets and ensure compliance—are essential for managing risk. They help organizations prevent fraud, prevent and detect errors, and meet regulatory requirements. Beyond risk mitigation, internal controls enhance financial accuracy, protect critical assets, and improve efficiency. When aligned with organizational goals, they create a framework that supports […]

Streamlining Operations with a Modern ERP System

Incompass Partners with AAFCPAs to Modernize Systems and Streamline Operations As the multi-service health and human services agency grew, despite its longstanding success, Incompass recognized the need to innovate to stay ahead of the evolving demands of the industry. Like many other large health and human services providers, the agency faced operational challenges, such as […]