Joyce Ripianzi

Building a Best-In-Class Finance Function

How do you know if your finance function is stuck in a rut? Do you manually produce the same reports, year after year—long after they have stopped being useful to management? Do you spend too much time making sure your numbers are right and not enough time figuring out what the numbers mean or what […]

May 16 is filing deadline for many tax-exempt organizations

AAFCPAs would like to remind nonprofit clients of an upcoming filing deadline of May 16, 2022. Those that operate on a calendar-year (CY) basis have certain annual information and tax returns they file with the IRS. These returns are: Form 990-series annual information returns (Forms 990, 990-EZ, 990-PF) Form 990-N, Electronic Notice (e-Postcard) for Tax-Exempt […]

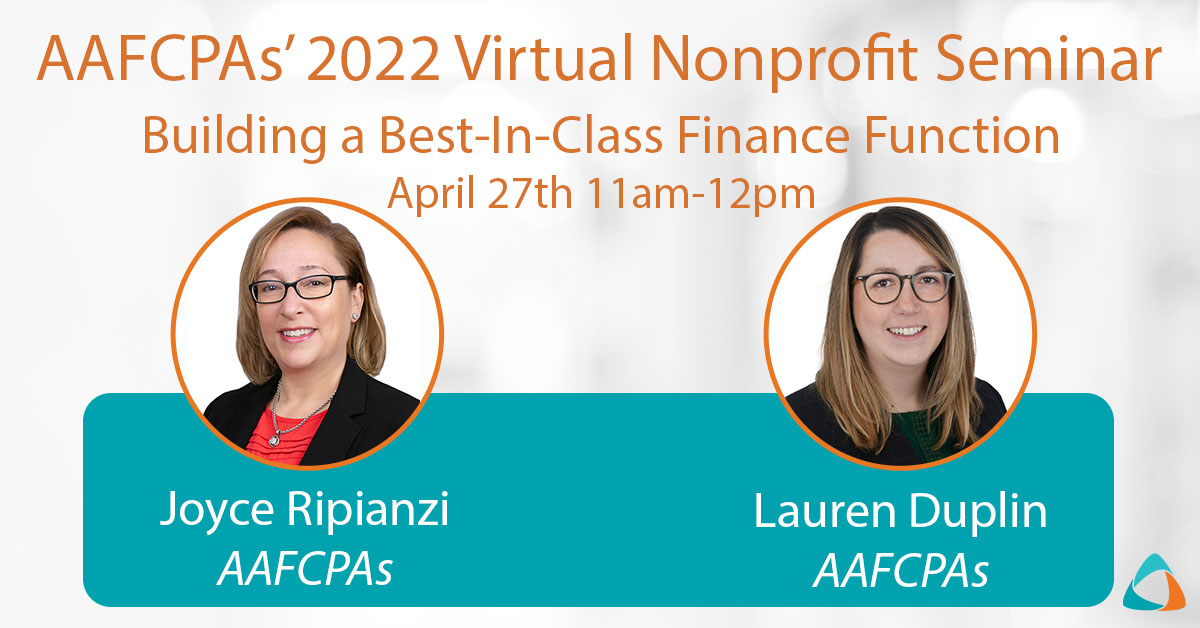

Live Session: Building a Best-In-Class Finance Function, April 27

AAFCPAs’ Annual Nonprofit Educational Seminar is Virtual Again in 2022! AAFCPAs is offering a full day of educational content (9am – 3pm) designed to educate, challenge, and inspire nonprofit professionals! As a client and/or friend of AAFCPAs, your registration is complimentary. Featured Session: Building a Best-In-Class Finance Function (11:05am – 11:45am) How do you know if […]

Webinar OnDemand: The Skills, Tools & Technology Needed Now to Be Future Ready

Accounting & finance departments and professionals at all levels are up for a tough challenge in the years ahead. The time to invest is now in order to be rewarded with greater opportunities, more impact, and more fulfilling work. Have you gone paperless? Are you utilizing the cloud? In this webcast, recorded April 2021 at […]

The Skills, Tools & Technology Needed Now to Be Future Ready

This year’s Annual Nonprofit Seminar is packed full of insight and inspiration to take nonprofits into the future, including discussions related to Pay for Success, Impact Reporting, and Leveraging Data Analytics & Predictive Modeling! Unfortunately, some nonprofits may be unable to equip for the future without addressing significant lags in the present. Time Is Of […]

AAFCPAs’ 2021 Nonprofit Educational Seminar

AAFCPAs is excited to announce that registration is now open for our 12th Annual Nonprofit Educational Seminar, scheduled for Wednesday, April 28. As a client and/or friend of AAFCPAs, your registration will be complimentary. We are excited this year to announce we will be hosting this popular event virtually! AAFCPAs’ Annual Nonprofit Educational Seminar is considered by […]

AAFCPAs to Discuss How Companies are Leveraging Technology Through the Pandemic

Joyce Ripianzi, CPA, partner and leader in AAFCPAs’ Managed Accounting Solutions (MAS) practice, will share her expertise as a panelist in an educational webinar on Tuesday, November 10th to discuss how companies are leveraging technology to survive, thrive, and grow through the pandemic. Sign up for this Webinar to hear insights on how companies are: […]

Why Nonprofits are Outsourcing Accounting

Skilled accounting and finance talent is scarce and in high demand, especially for nonprofits who often struggle with expectations to keep “overhead” low. These labor challenges are national and expected to intensify over time. Knowledge-intensive industries like financial and business services are expected to continue to be hit hard by the talent crunch. Nonprofits also […]

Disaster Assistance Loans for Small Businesses & Nonprofits Impacted by Coronavirus

AAFCPAs would like to make clients aware that the U.S. Small Business Administration (SBA) will offer low-interest federal disaster loans for working capital to Massachusetts small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19). SBA Economic Injury Disaster Loan Small businesses, private nonprofit organizations of any size, small agricultural cooperatives and […]