The Markets React to Viral Outbreak

Like you, we too are monitoring the warning from the CDC on Tuesday that the US should prepare for severe disruptions to everyday life as it relates to the Coronavirus. As you can expect, we are keeping a close eye on the related 1,900-point drop to the DOW. Indeed, it is a scary time, but from an investment perspective, we would like to alleviate some of your fears related to recent market performance. Historically, Wall Street’s reaction to such epidemics and fast-moving diseases is often short-lived.

Why is the stock market so rattled?

Uncertainty: As you know, equity markets react unpredictably to the unknown. The market is very efficient, that is, all information is priced into the market and valuation of stocks and bonds reflects available information.

Impact to Global Growth: In the past few decades, China has arguably become the manufacturing superpower to the global growth engine. As a result of the virus, and in an abundance of caution, global companies have warned about earnings impact of the disease and on anticipated disruptions of global supply chains. Oxford Economics, a leading economic research center, warned that this virus could drop 1.3% off global GDP, equal to $1.1 trillion in lost income.

As a result, stocks across the globe are being repriced to account for the impact of this pandemic.

What does the past tell us?

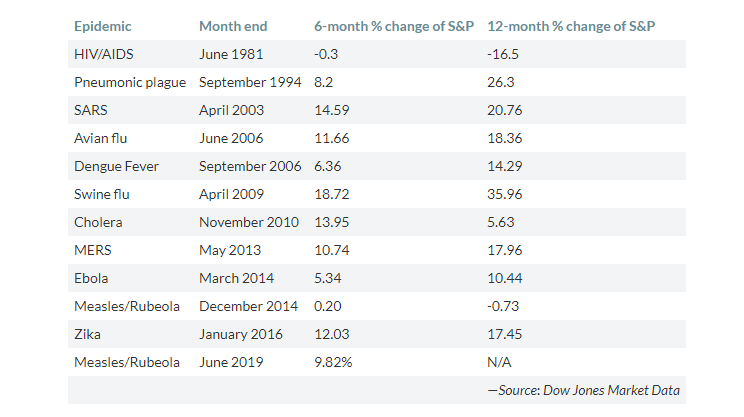

We are not drawing a fixed conclusion, as past outbreaks occurred at very different times in the stock market cycle. However, we may be able to gauge the ultimate impact of COVID-19 by reflecting on the market’s performance during the onset of other infectious diseases. A report published by MarketWatch on February 24th outlines how the stock market has performed during past viral outbreaks. “Indexes had managed to shrug off the contagion from outbreaks in the past… (see attached table)”

Diversification & Discipline Matters

As this coronavirus has expanded globally and stocks have sold off, yields have plummeted. The 10-year treasury yield hit an all-time low on Tuesday of 1.31%. This flight to safety for investors has pushed yields down on bonds and prices up. That means that the bonds in your portfolio are serving as the safe haven to your portfolio. Again, this underscores why AAFCPAs Wealth Management believes bonds continue to play an important part of your portfolio.

We believe a disciplined approach to portfolio construction is key to managing investor risks related to the current market uncertainty. No one knows what the market is going to do for sure. We remain prepared to act as appropriate.

If you have any questions about your personal financial plan, please contact: Carmen Grinkis, PhD, CLTC, CFP® at 774.512.4061, cgrinkis@nullwealth.aafcpa.com; Andrew E. Hammond, CFP® at 774.512.4143, ahammond@nullwealth.aafcpa.com; or your AAFCPAs Wealth Advisor.

AAF Wealth Management is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where AAF Wealth Management and its representatives are properly licensed or exempt from licensure. This blog is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by AAF Wealth Management unless a client service agreement is in place.