Business Process Optimization

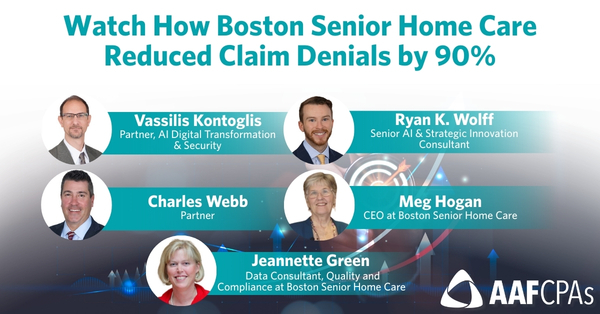

Watch How Boston Senior Home Care Reduced Claim Denials by 90% — A Live Client Webinar

Boston Senior Home Care slashed monthly claim denials from $65,000 to just $6,000 by automating one of the most time‑consuming, risk‑prone processes in their organization. Watch how this transformation delivered real‑time visibility, restored staff capacity, and created a proactive model any Aging Services Access Points (ASAPs) can replicate. Speakers include Vassilis Kontoglis, Partner, AI Digital […]

CSV Import/Export, Batch, or Real-Time? How to Choose the Right System Integration Method

The promise of seamless system integration—real-time dashboards, automatic updates, reduced manual handling—often sounds too good to pass up. Vendors tout live data connections, executives expect instant visibility, and teams grow impatient when information does not flow. But full integration is not always necessary or worth the investment. In many cases, a well-mapped file transfer or […]

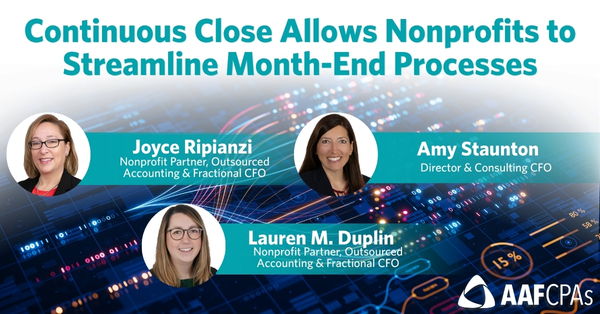

Continuous Close Approach Allows Nonprofits to Streamline Month-End Processes

For many nonprofits, month-end close follows a familiar rhythm: reconcile books, gather receipts, post final entries, and generate reports. It is a routine shaped by habit and deadlines, often carried out under pressure. But in practice, this model can create as much friction as it resolves, especially when organizations rely on outdated systems or must […]

There Are Automation Opportunities in Your Everyday Operations

Most organizations are busy enough just keeping up with daily responsibilities. When operations rely on habit and deadlines, it is easy to overlook the quiet drag of manual tasks, i.e. the form re-entered in three systems, the spreadsheet passed around for approvals, the weekly report that takes hours to compile. These inefficiencies often remain hidden […]

Providers’ Council Invites AAFCPAs and Incompass to Share ERP Insights

Struggling to streamline your operations? Discover proven strategies to cut inefficiencies and boost visibility in this exclusive, free webinar for executive, finance, and operations leaders—hosted by AAFCPAs and the Providers’ Council. Hear How Incompass Unlocked Efficiencies Many human services providers face process delays, compliance risks, and complex reporting challenges due to disconnected billing, EMR, and […]

Scaling Without Hiring Begins With Process

In the article: Budget cycles are tightening. Costs are up. Many organizations have been forced to operate with fewer resources, even as expectations and workloads grow. For some, especially in sectors like healthcare or nonprofit, the usual options for relief, such as hiring or expanding capacity, are not realistic. What remains is often overlooked: the […]

How to Build a Reliable System of Record with Practical Data Strategy Insights

Financial systems are rarely as connected as they appear. As organizations grow and adopt specialized tools, each serving a distinct purpose, questions begin to emerge. Where does the most accurate version of a transaction live? Which system should drive reporting? Where does accountability reside? Without a clearly defined system of record, even routine tasks may […]

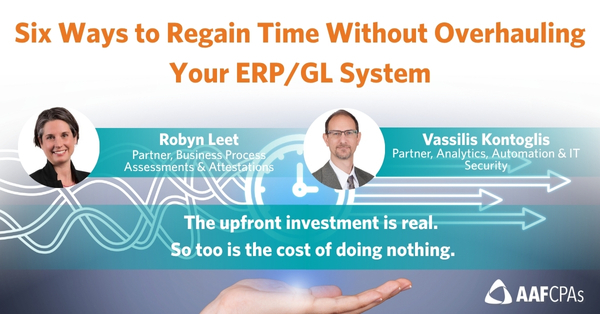

Six Ways to Regain Time Without Overhauling Your ERP/GL System

Some decisions are delayed not because they are unimportant, but because they are uncomfortable. For many finance teams, the thought of changing systems or introducing automation falls into that category—too expensive, too complex, too disruptive. But staying the course has its own cost. Hours spent maintaining spreadsheets, tracking deadlines manually, or entering transactions line by […]

Is Your Tech Stack Built for Real-Time Decision Making?

Finance leaders face increasing pressure to produce faster, accurate reports and maintain strong internal controls—all while managing lean teams and limited resources. Technology should help ease this burden. However, when systems are disconnected, it often creates more work. Teams spend more time managing data across platforms than leveraging it for decision-making. Reconciliations get delayed. Reports […]