280E Tax

ESOPs May Be the Key to Operating Tax-free in the Cannabis Space

Cannabis operators focus heavily on tax mitigation, employee retention, growth strategies, and profitable exit. A properly structured ESOP is a great tool to accomplish all those goals and more. In a recent webinar, “Cannabis ESOPs – The Industry Game Changer”, AAFCPAs’ David McManus, CPA, CGMA, Tax Partner & National Cannabis Practice Leader and Joshua England, LLM, Esq., […]

TerrAscend Corp. Joins Other Operators Changing 280E Tax Position

AAFCPAs would like to make cannabis clients aware that TerrAscend Corp., in its fourth-quarter earnings call, announced it would no longer be making tax payments under Section 280E of the Internal Revenue Code. The company’s Chief Financial Officer noted its legal basis in doing so comes from a legal interpretation based on a similar position […]

Tax Season Brings Rise in Cyber Crime

Cybercriminals are looking for ways to capitalize on tax season, with scams on the rise as businesses and individuals prepare to file returns. This means the simple act of opening an email or answering a call could put you at risk of identity theft or return preparer fraud. Making matters worse is a rise in […]

AAFCPAs Provides Tax and Business Guidance at Cannabis Industry Conferences

AAFCPAs Provides Tax and Business Guidance at Cannabis Industry Conferences AAFCPAs’ Cannabis Practice leaders David McManus, CPA, CGMA and Joshua England, LLM, Esq. have been invited to present at two industry conferences in August 2023. AICPA & CIMA Cannabis Industry Conference David McManus, CPA, CGMA is pleased to present CAN2315, Taxes: Part 1 at the […]

AAFCPAs Invited to Speak at Maine Cannabis Convention

AAFCPAs’ Cannabis Practice leaders David McManus, CPA, CGMA and Joshua England, LLM, Esq. have been invited to speak at the Maine Cannabis Convention/Homegrown Trade Show being held at the Augusta Civic Center in Augusta, Maine. The event will take place on Saturday, August 12 and Sunday, August 13, 2023 from 10 AM to 3 PM. […]

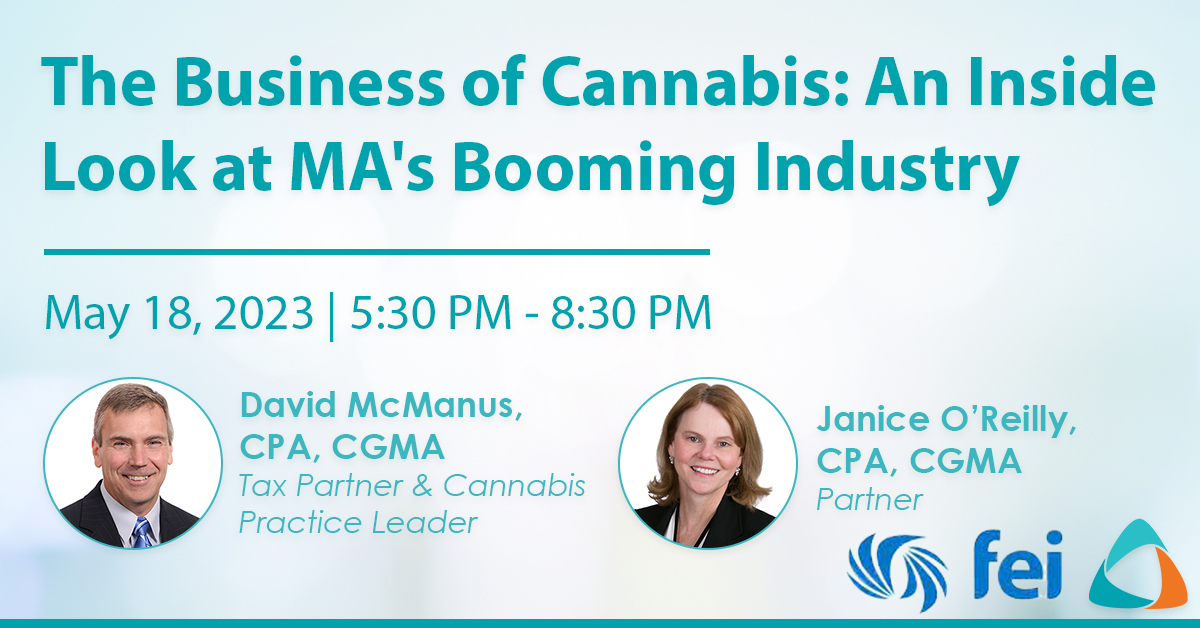

AAFCPAs to Present “The Business of Cannabis” at FEI-Boston

AAFCPAs’ Cannabis Practice leaders have been invited to speak at FEI Boston’s “The Business of Cannabis: An Inside Look at MA’s Booming Industry”. The event will take place on May 18, 2023 at Solar Therapeutics in Somerset, MA from 5:30 through 8:30 PM. Join regional finance professionals for an exclusive inside look into the rapidly […]

AAFCPAs Invests in Solution to Streamline Indirect Tax Compliance

Boston (December 9, 2022) – AAFCPAs, a leading CPA and Consulting firm based in New England, today announced its recent strategic partnership with Synexus Tax Solutions, to help clients simplify and streamline state tax compliance. AAFCPAs now combines our years of tax expertise with new state-of-the art technology to deliver multistate indirect tax compliance so […]

Year-end planning: focus on budgets and tax for cannabis operators

Cannabis Business Executive (November 22nd, 2022) – As we approach the close of a turbulent year, cannabis operators have an opportunity to establish a strong finance and tax strategy heading into 2023. You can enter the year from a position of strength by focusing on tax planning, tax compliance, and budgeting to ensure healthy cash […]

Watch Now: 2022 Year-End Tax Planning & Compliance for Cannabis Businesses

Year End Cannabis Business Tax Planning In this live webinar, AAFCPAs’ Cannabis Practice Leaders covered Federal & State tax planning strategies for cannabis businesses. Listen to hear what you may need to consider now to optimize your 2022 tax position. Topics Covered Include: Key considerations for Tax Compliance Readiness 280E Tax key considerations, and the […]