Industry

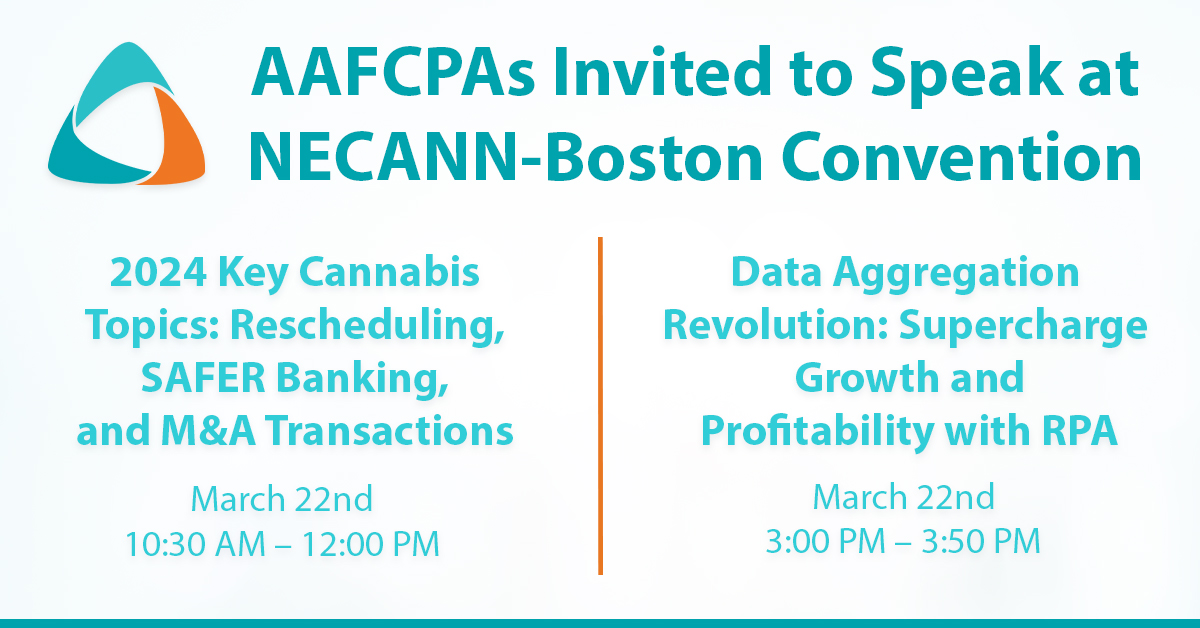

AAFCPAs Invited to Speak at NECANN-Boston Convention

AAFCPAs’ Vassilis Kontoglis, Janice O’Reilly, and Dave McManus were invited to speak in two separate sessions at NECANN’s 2024 Boston Convention that was held at the Hynes Convention Center in Boston, Massachusetts. 2024 Key Cannabis Topics: Rescheduling, SAFER Banking, and M&A Speakers: Dave McManus, Ronald Lipof, Melissa Maranda, J.D., and Michael Ross When: Friday, March […]

Philip Deng to Keynote Nonprofit Seminar

AAFCPAs is pleased to announce that Philip Deng, recognized for his ability to leverage advanced technology in the nonprofit space, will be keynote speaker at its 2024 Virtual Nonprofit Educational Seminar on April 24th. Deng is a nonprofit veteran and CEO of Grantable, an AI-assisted grant writing solution. Unlocking the Power of AI with Philip […]

Guidance for Independent Schools on FASB’s New CECL Model

The long-awaited Current Expected Credit Losses (CECL) Standard, Accounting Standards Update 2016-13 – Financial Instruments-Credit Losses (Topic 326) is effective for nonpublic businesses and not-for-profit entities for fiscal years beginning after December 15, 2022. This means CECL is in effect during fiscal year 2024 for independent schools with June 30 year ends. AAFCPAs advises that independent […]

Lawsuit Returns $1.2M in Community Impact Fees to Cannabis Businesses

AAFCPAs would like to make Cannabis clients aware that Caroline’s Cannabis recently reached a $1.2 million settlement with the town of Uxbridge, Massachusetts contesting millions of dollars in community impact fees imposed on marijuana businesses. The lawsuit claimed that the town had not provided any documentation justifying a host community agreement (HCA) fee, which is […]

Social Equity Program Application Opening February 5th

The Massachusetts Cannabis Control Commission announced that it will begin accepting applications for the fourth cohort of its Social Equity Program (SEP) starting Monday, February 5. Applications will be accepted until April 30th, according to its press release. Applicants are eligible for the Social Equity Program (SEP) if they demonstrate they meet at least one […]

BBJ: How to apply to state cannabis grants, according to finance expert Dave McManus

Boston Business Journal (January 31, 2024) – After years of waiting, cannabis social equity companies in Massachusetts can start applying to state grants to support their businesses. Last week, the state Executive Office of Economic Development launched the “Immediate Needs Grant Program,” which is first release of grants from the state’s Cannabis Social Equity Trust […]

Construction Analytics Overview and Software Demo

AAFCPAs’ Construction Practice is pleased to share an informative dialogue about which construction financial analytics are most crucial for controlling costs, ensuring profitability, and managing project efficiency. We also offer a product demonstration presented by ProNovos, a leading financial analytics solution tailored to suit the needs of the construction industry. This webinar OnDemand will reveal […]

Immediate Needs Grant Program Funding Available, Application Due February 15th

AAFCPAs would like to make Cannabis clients aware that the Massachusetts Cannabis Control Commission announced on January 23rd the availability of financial resources with the launch of its first funding from the Cannabis Social Equity Trust Fund (Trust Fund). The Immediate Needs Grant Program will offer grants to support cannabis business license holders with urgent […]

Massachusetts’ Cannabis Social Equity Trust Fund to Soon Offer Grants

AAFCPAs would like to make clients aware that Massachusetts’ supplemental budget passed late last year includes a procedural fix to the Cannabis Social Equity Trust Fund. This means the state-wide cannabis industry, particularly communities of color, may soon gain access to millions in state funding meant to diversify entrepreneurship opportunities. One of the greatest obstacles […]