Shawn P. Huxley

Understanding Secure 2.0, and how it Affects Plan Sponsors

SECURE 2.0—so-called because it builds on the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019—is legislation designed to substantially improve retirement savings accounts, including 401(k)s and 403(b)s, in the U.S. There’s a host of provisions in the bill and in this webcast, recorded April 2023 at AAFCPAs’ Nonprofit Educational Seminar. AAFCPAs’ Employee […]

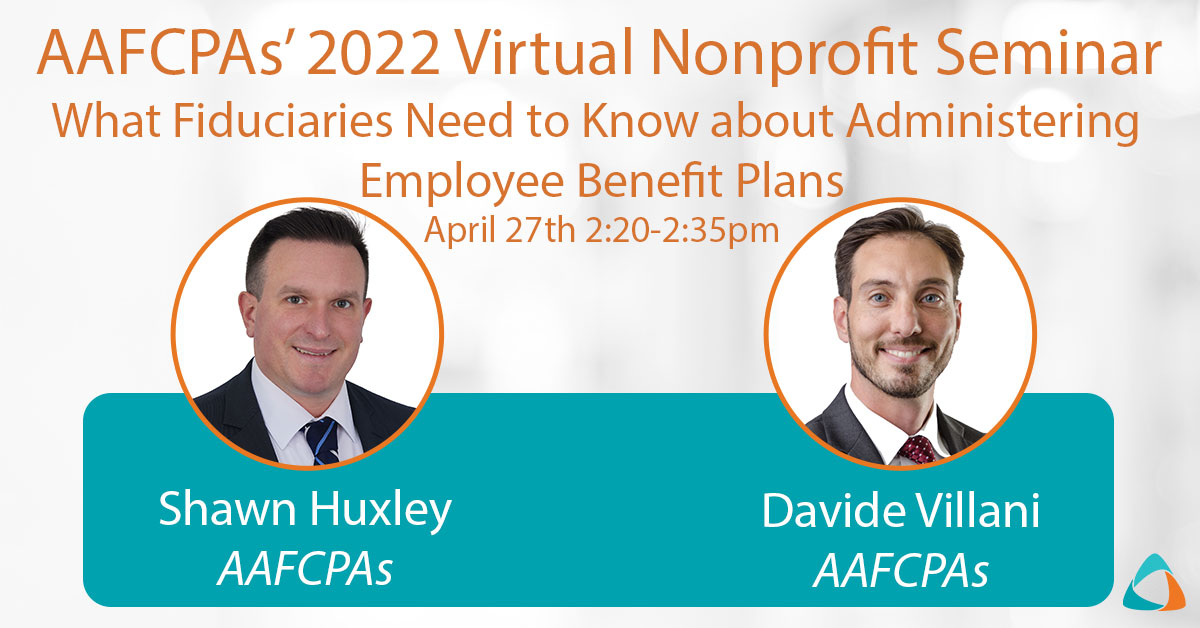

What Fiduciaries Need to Know about Administering Employee Benefit Plans

In this webcast, recorded April 2022 at AAFCPAs’ Nonprofit Educational Seminar, leaders in AAFCPAs’ Employee Benefit Plan Audit & Consulting practice, Shawn Huxley and Davide Villani, provide attendees with what they need to know about their obligations to provide promised benefits and to satisfy ERISA’s requirements for managing and administering private retirement and welfare plans. This includes an […]

Live Session: What Fiduciaries Need to Know about Administering Employee Benefit Plans , April 27

AAFCPAs’ Annual Nonprofit Educational Seminar is Virtual Again in 2022! AAFCPAs is offering a full day of educational content (9am – 3pm) designed to educate, challenge, and inspire nonprofit professionals! As a client and/or friend of AAFCPAs, your registration is complimentary. Featured Session: What Fiduciaries Need to Know about Administering Employee Benefit Plans (2:20pm – […]

Shawn Huxley Joins AAFCPAs’ Employee Benefit Plan Audit Practice

Boston, MA (01/24/22) – AAFCPAs, a best-in-class CPA and consulting firm known for assurance, tax, accounting, wealth management, business process, and IT advisory solutions, today announced the addition of Shawn P. Huxley, CPA, MSA, as a Partner in the firm’s Employee Benefit Plans practice. Shawn joins AAFCPAs with 15 years of public accounting experience leading […]