Joshua England

Stock Sale Essentials: Key Steps for Private Company Owners

How Can Private Company Owners Prepare for a Successful Stock Sale? When a private company is sold, every contract, employee relationship, and financial detail faces close examination. In a stock sale, ownership, along with the company’s legacy, obligations, and opportunities, transfers to the buyer. While the process can be complex and demanding, thorough preparation by […]

Give the Gift of an Estate Plan

The holiday season brings thoughts of giving—carefully chosen gifts that show love, create lasting memories, and sometimes provide practical value for years to come. For families thinking beyond this year’s celebrations, the most meaningful gifts might be the ones that keep giving long after the wrapping paper is cleared away. Estate planning in 2025 and […]

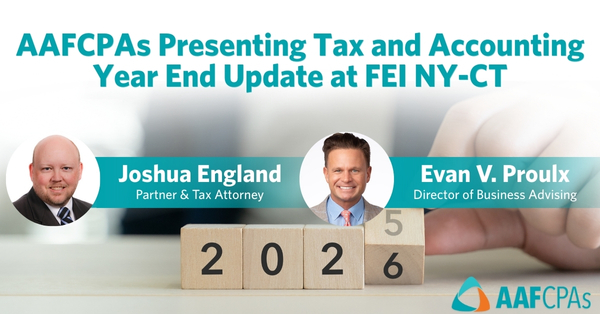

AAFCPAs Presenting Tax and Accounting Year End Update at FEI NY-CT

AAFCPAs is proud to participate in the Connecticut/Westchester chapter of Financial Executives International’s (FEI’s) Year End Annual Tax and Accounting Update and Networking Social and Dinner, a gathering that offers fresh insight and meaningful connection as finance leaders prepare for the close of the year. The program offers two CPE credits through focused tax and […]

Seminar Recap: Tax Strategies for Cannabis Operators 2025

During AAFCPAs’ recent Tax Strategies for Cannabis Operators webinar (October 2025), AAFCPAs’ Cannabis practice leaders presented practical guidance to operators on navigating Section 280E compliance, optimizing cost of goods sold, managing cash flow and operational challenges, and evaluating strategies for exit planning, including Qualified Small Business Stock and employee ownership structures. The past year for […]

How Early Planning Maximizes the Value of a Business Sale

Financial outcomes from a business sale reflect the planning and decisions made long before the deal closes. Thoughtful preparation allows you to structure the transaction and manage proceeds deliberately. Starting early—think years ahead—creates space to protect what you’ve built, optimize your tax strategy, and plan the next chapter. A measured approach ensures that funds are […]

What OBBB Means for Estate Tax and Wealth Transfer

The One Big Beautiful Bill (OBBB) Act raises the federal estate tax exemption to $15 million per individual beginning January 1, 2026, a permanent change indexed for inflation. For many families, this eases the prospect of federal estate tax altogether. Yet planning remains as vital as ever. The increase does not replace the value of […]

Tax Strategies for Cannabis Operators Webinar 2025

2025 Tax Planning for Cannabis Operators Webinar Navigate complex tax rules and maximize efficiency with insights from AAFCPAs’ 2025 Tax Planning for Cannabis Operators webinar. Learn strategies to address 280E compliance, optimize operations, and implement tax-efficient plans for your business. In this session, you will learn: Webinar OnDemand

Individual/Family Tax and Wealth Preservation Webinar 2025: Watch our Webinar OnDemand

2025 Individual and Family Tax and Wealth Preservation Webinar Protect and grow personal wealth with strategies from AAFCPAs’ 2025 Individual and Family Tax and Wealth Preservation webinar. Gain insights on preserving assets, managing evolving tax rules, and preparing for changes in estate and retirement planning. In this session, you will learn: Webinar OnDemand

Why Complex Trusts Matter for High-Net-Worth Investors Under OBBB

A provision in the One Big Beautiful Bill (OBBB) Act has renewed interest in a once-overlooked planning strategy: the use of a complex trust as a standalone tax-paying entity. While the concept is not new, recent updates including expanded deductions for real estate taxes make the structure more practical and more compelling, particularly for high […]