Blog

Our Blog acts as a great resource of topical information for the finance community. Use the search function to find specific topics or browse our categories to benefit from our past shared learnings.

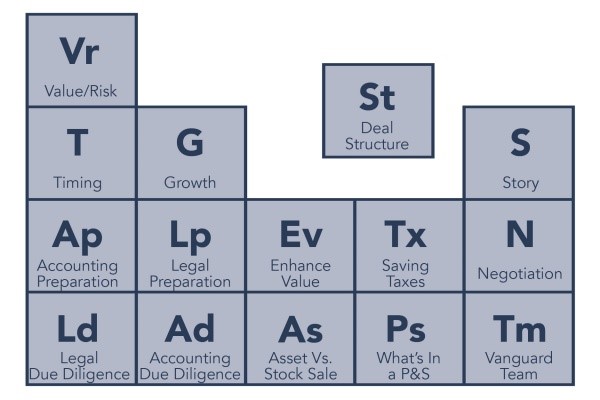

AAFCPAs’ Jack Finning and Janice O’Reilly to Present Educational Workshops on Preparing to Sell a Closely-Held Business

AAFCPAs Partners Jack Finning, CPA, CGMA and Janice O’Reilly, CPA, CGMA will present educational workshops on October 24th, providing guidance and key considerations when selling a closely-held business. These sessions are part of Beacon Equity Advisors’ annual Elements Conference, organized for the benefit of private company business owners who want to learn about: timing the […]

Webinar: 2018 Year-End Tax Planning for Individuals & Families

Information continues to emerge as a result of the monumental Tax Cuts & Jobs Act. For privately-held companies, the TCJA impacts your financial statements, operating model, liquidity, investments and capital, and people. For individuals, the TCJA impacts personal withholdings, charitable giving, family & education, retirement, and estate planning. AAFCPAs is pleased to offer a timely, […]

Webinar: 2018 Year-End Tax Planning for Privately-Held Companies (Part 2)

Information continues to emerge as a result of the monumental Tax Cuts & Jobs Act. For privately-held companies, the TCJA impacts your financial statements, operating model, liquidity, investments and capital, and people. For individuals, the TCJA impacts personal withholdings, charitable giving, family & education, retirement, and estate planning. AAFCPAs is pleased to offer a timely, […]

Webinar: 2018 Year-End Tax Planning for Privately-Held Companies (Part 1)

Information continues to emerge as a result of the monumental Tax Cuts & Jobs Act. For privately-held companies, the TCJA impacts your financial statements, operating model, liquidity, investments and capital, and people. For individuals, the TCJA impacts personal withholdings, charitable giving, family & education, retirement, and estate planning. AAFCPAs is pleased to offer a timely, […]

AAFCPAs to Lead Medicare Cost Report Training for MA Community Health Centers

AAFCPAs’ Matt Hutt, CPA, CGMA and Courtney McFarland, CPA, MSA, in collaboration with the Massachusetts League of Community Health Centers (The League) will again present coveted guidance on the Medicare Cost Report for Massachusetts community health centers. When: October 17th, 2018 | 10:00am – 11:30am Where: Live Webinar This interactive workshop will provide: Guidance to […]

AAFCPAs Presents Workshop on Nonprofit Financial Statement Framework for Lawyers Clearinghouse

ASU 2016-14, Not-for-Profit Entities (Topic 958), Presentation of Financial Statements of Not-for-Profit Entities, affects substantially all nonprofits as well as creditors, donors, grantors, and others that use their financial statements. AAFCPAs’ Amanda Pelcher, CPA will provide insight to the Lawyers Clearinghouse’s network of nonprofits during a workshop she will give on Understanding the New Nonprofit Financial Statement […]

AAFCPAs’ Brittany Besler, CPA, JD, MBA to Present Legal Seminar on Nonprofit Compliance Requirements

AAFCPAs Tax Strategist Brittany Besler, CPA, JD, MBA will volunteer her expertise and lead Lawyers Clearinghouse’s Legal Workshop for Nonprofits: How to Maintain Nonprofit, Tax-Exempt, and Public Charity Status on October 2nd in Boston, MA. This two-hour educational workshop offers an overview of compliance requirements with various government agencies and practical tips for nascent nonprofits, including […]

IRS Issues Proposed Regulations on Charitable Contributions and State and Local Tax Credits

The IRS recently released proposed regulations addressing the state and local itemized tax deduction, available to individual taxpayers on their Federal tax returns. The regulations also apply to trusts and decendents’ estates. Under the Tax Cuts and Jobs Act, the state and local tax deduction (consisting primarily of income, real estate and other property, and […]

AAFCPAs Wealth Management Advises Clients to Pursue Lines of Defense in Protecting Your Credit

Approximately 1 in 2 Americans had their personal information compromised as a result of a 2017 data breach at Equifax, and as a result are now at an increased risk for identify theft and financial fraud. Identify theft is an increasing problem for all people. In response, Congress initiated a new credit freeze law protecting […]