—By Author

Leadership Unplugged: Carla McCall to Share Bold Insights at AICPA Women’s Global Leadership Summit

Carla McCall, CPA, CGMA, Managing Partner at AAFCPAs and Immediate Past Chair of the American Institute of CPAs (AICPA), is invited to speak at the 2025 AICPA Women’s Global Leadership Summit, taking place November 10–12 at the Omni Nashville Hotel in Nashville, Tennessee. McCall will join distinguished AICPA leaders for Leadership Unplugged—an energizing C-level conversation […]

MA Nonprofit Annual Report Due by Nov 1

AAFCPAs reminds clients that every nonprofit corporation organized under the laws of the Commonwealth of Massachusetts must file a nonprofit annual report with the Corporations Division on or before November 1st of each year. Failure to file can lead to a loss of good standing as a corporation in Massachusetts. Learn more here: https://www.sec.state.ma.us/cor/corpweb/cornp/npfrm.htm

How Organizations Use AI to Monitor Systems and Respond to Threats

Artificial intelligence is reshaping how organizations think about system security and operational oversight. Unlike traditional tools built on fixed rules and reactive triggers, AI systems bring a capacity for adaptation—learning from patterns, anticipating irregularities, and flagging potential issues before they become disruptive. This shift not only makes systems more responsive but also gives IT and […]

What SaaS Companies Need to Know About State Tax Obligations

As software companies shift to subscription-based models and expand across state lines, tax obligations grow less predictable—and more costly when overlooked. Sales tax on Software-as-a-Service (SaaS) is no longer limited to where a company is headquartered. Instead, tax exposure may follow where products are used, where customers are billed, or even where remote team members […]

Streamline Your Budgeting Process in Our Webinar OnDemand

Take the guesswork out of budgeting. Join Wendy Smith, CPA, Consulting CFO, Business Transformation & Intelligence at AAFCPAs, along with Martus’ Christopher C. Grady for this recorded webinar and see how Martus™ transforms budgeting from a manual, time-consuming process into a streamlined, efficient workflow. Martus works with platforms like Intacct, QuickBooks, and Microsoft 365 Business […]

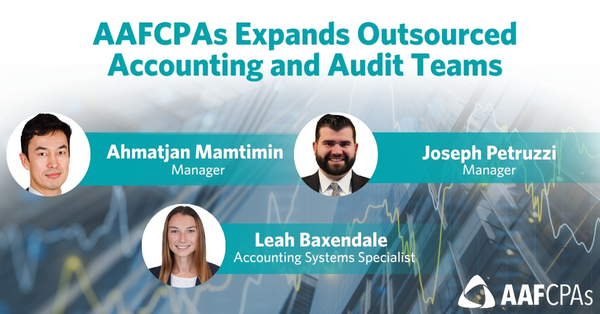

AAFCPAs Expands Outsourced Accounting and Audit Teams

AAFCPAs, a U.S. Top 100 CPA and consulting firm, is expanding its talent community with the addition of three talented and accomplished professionals. Their backgrounds span education, healthcare, and nonprofit sectors, bringing a combination of technical depth and practical insight that enhances AAFCPAs’ ability to deliver proactive, results-oriented solutions for complex client needs. Ahmatjan advises […]

Helping Clients Get Audit-Ready: How Advisory Team Supports Auditors

AAFCPAs’ Outsourced Accounting & Fractional CFO Practice Helps Make Audits Smoother and More Efficient As year-end approaches, many finance teams and their external auditors navigate the season’s challenges with a shared goal: ensuring financials are audit ready. Disorganized records, such as missing source documents or unreconciled general ledgers, can add unnecessary complexity to this process, […]

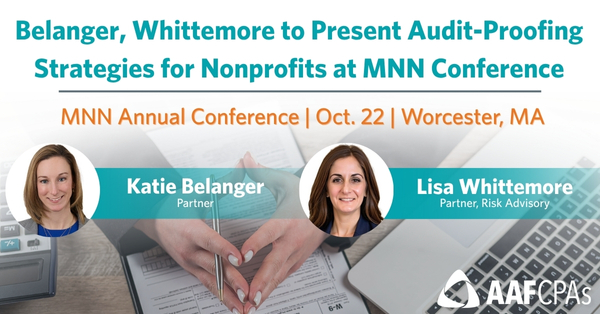

Belanger, Whittemore to Present Audit-Proofing Strategies for Nonprofits at MNN Conference

Katie Belanger, Partner at AAFCPAs and leader in the firm’s Human & Social Services practice along with Lisa Whittemore, Partner, Risk Advisory will present at the 2025 MNN Annual Conference on October 22 at the DCU Center in Worcester, Massachusetts. This workshop, A CPA, CFO and CFE Walk Into A Bar… Audit-Proofing Your Organization, equips […]

Watch Understanding Your ITGCs: Why They Matter and How to Strengthen Them

IT General Controls (ITGCs) are under increasing scrutiny—and the consequences of failure are growing. CEOs, CFOs, and Boards are often blindsided by assessment findings, risk exceptions, and regulatory pressure tied to weak or outdated IT controls. These issues aren’t just technical—they’re strategic, with real implications for financial integrity, compliance, and reputation. In this webinar, we […]