About AAFCPAs

AAFCPAs to Present Workshop on Anticipating Fraud at NBOA Conference, San Diego, CA

AAFCPAs has been selected to present an educational workshop: Rogue Waves Sink the Unwary Vessel: Think Like a Fraudster at the National Business Officers Association (NBOA) Conference in San Diego, CA, March 3-6. This is a must-attend conference for CFOs, heads of school and other business and operational leaders in nonprofit K-12 education, providing exceptional learning opportunities […]

Andrew Hammond, CFP® will moderate FEI-Boston’s March 2019 Executive Event: What Did We Learn in 10 Years & Where Do We Go From Here?

Andrew Hammond, CFP®, Partner & Wealth Advisor at AAFCPAs Wealth Management, will moderate a seasoned panel of peer investment strategists discussing what we should have learned since the recession of 2008-2009, and how the equity community and government is working to minimize the risk of this happening again. The Dow plunged 54% in 18 months between […]

Where do VGo from here? AAFCPAs’ Innovation Lab in Action

Innovation is often considered the path to growth – both for a company and for individuals. While we agree that new product or service approaches are exciting, we also believe that innovative ideas are critical to improving our culture and the way we work together. We look for breakthroughs that help us excel, whether coming […]

Nonprofit Educational Seminar & Reception | 4.25.19

AAFCPAs’ Annual Nonprofit Educational Seminar is considered by many nonprofit CFOs and Executive Directors to be the premier nonprofit finance educational event of the year!

AAFCPAs Wealth Management Welcomes Emily Levine, Investment Operations Specialist

AAFCPAs Wealth Management continues to grow and invest in team capabilities, and we are pleased to announce the addition of Emily Levine as Investment Operations Specialist. Emily has 15+ years’ experience in financial services and joins our growing team of wealth advisors. “In response to our on-going commitment to offer each client a personalized, holistic planning approach, […]

AAFCPAs Promotes Four to Partner to Support Firm Growth

Westborough, MA 1/8/2019 – AAFCPAs is excited to announce the promotion of four additional Partners to our growing team: Andrew Hammond, CFP®, Carmen Grinkis, PhD, CLTC, CFP®, Matthew McGinnis, CPA, and Davide Villani, CPA, CGMA are fully engrossed in the industries we serve, and work closely together to best serve our diverse client base with the distinction of excellence. Carmen […]

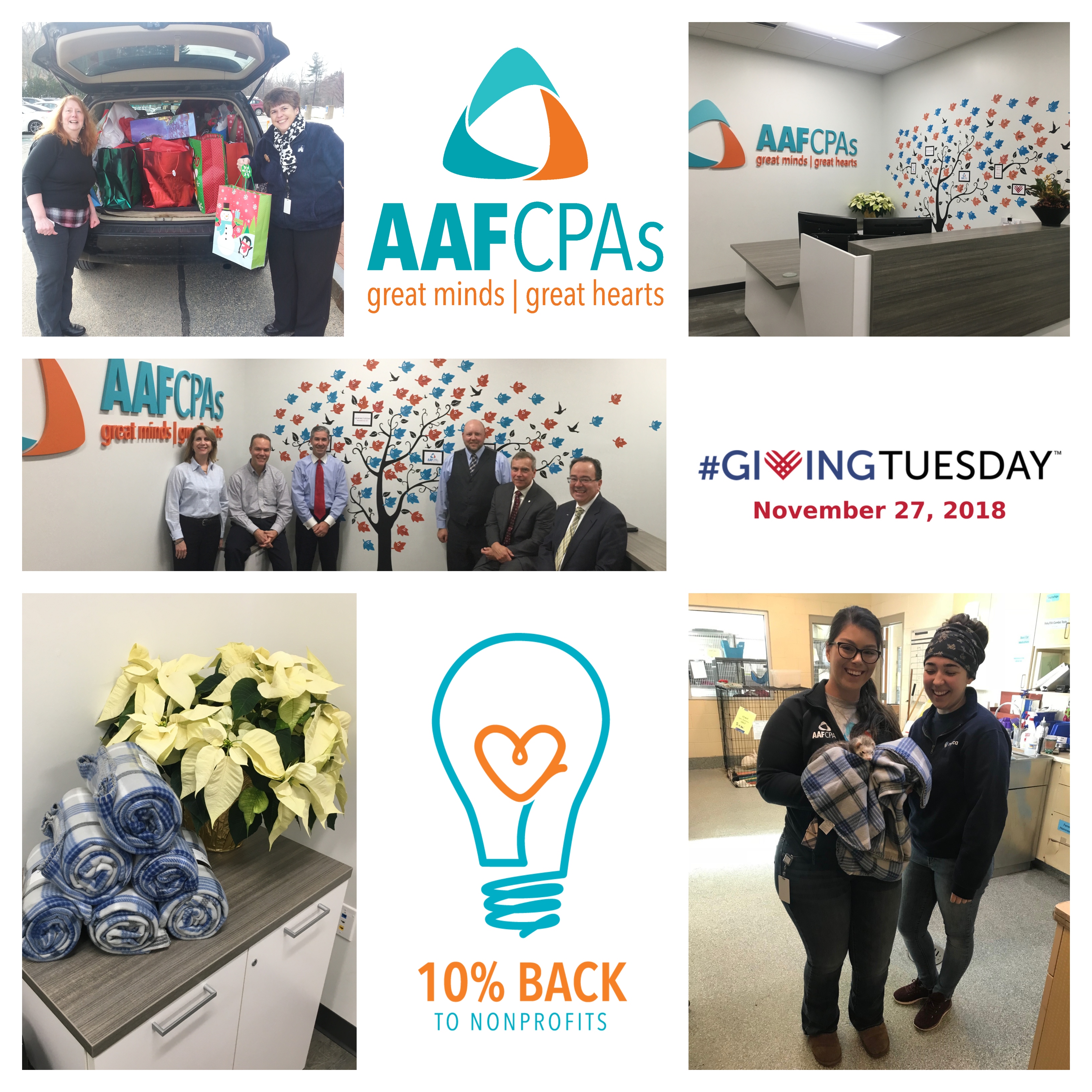

AAFCPAs’ #GivingTuesday Match Donates Over $31K to Charities

AAFCPAs participated again this year in #GivingTuesday, on November 27th, 2018, a global day dedicated to giving! Collectively, the firm and its team members donated $31,778 to mission driven nonprofits! HOW DID AAFCPAs TAKE PART IN THE SPIRIT OF GIVING? Extra incentives to give! For #GivingTuesday, AAFCPAs and our company-sponsored Charitable Foundation matched employee gifts 1:1 […]

Warm and friendly wishes from AAFCPAs

Thank you for your business and loyalty. We admire your passion, entrepreneurial spirit and all the great things you accomplish. Please know that it is our privilege to be part of your advisory team. All of us at AAFCPAs wish you and your family a joyful holiday season! May you enjoy a wonderful new year, […]

What Does Rising Talent Look For in a CPA Firm?

Public accounting has changed a great deal in order to keep pace with the way client needs have changed, requiring specifically talented professionals to evaluate these needs from multiple angles. This may be one reason that rising stars in the CPA world need a different type of environment to learn and thrive. At our firm, […]